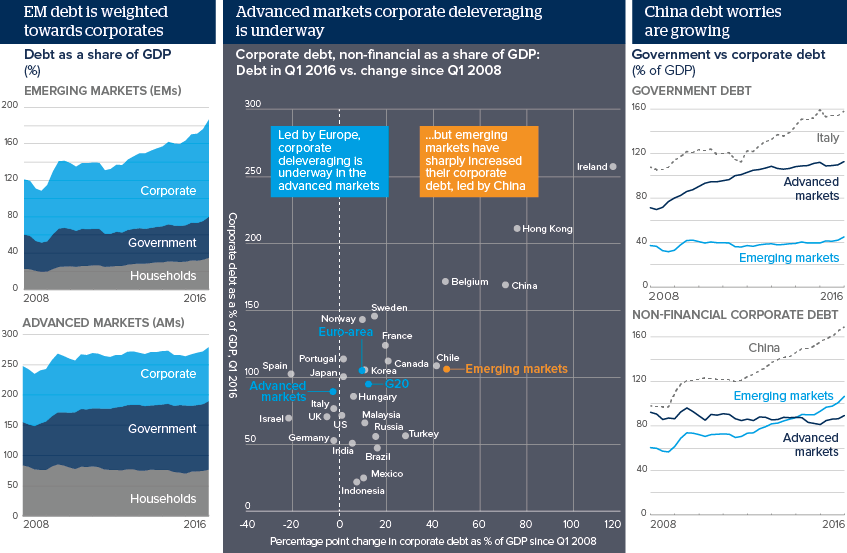

Global debts will be costlier to pay off in 2017-18

The IMF Financial Stability Report urges policymakers to tackle debts that stand at a record high 225% of world GDP

Source: Bank for International Settlements

Outlook

Emerging markets' corporate debt has ballooned since the global financial crisis, due to ultra-loose monetary conditions and comparatively strong growth prospects.

Since the US election investors have fled from bond markets on fears that if President-elect Donald Trump implements his 1-trillion-dollar stimulus plan, aggressive monetary tightening will be needed to combat the debt-fuelled inflation surge. Japan and the euro-area will also start tapering their quantitative easing programmes in 2017-18.

Paying higher interest on debt may come as a shock after years of low rates. There is a risk that funds that would have been used for productive investment may be diverted to interest payments, weighing on global growth prospects.

Impacts

- Higher interest payments may have been underestimated by firms, governments and consumers and may weigh down spending more than expected.

- 'Overburdened' monetary policy is losing efficacy and distorting markets, with bond markets already pricing in higher interest rates.

- Non-performing loans have risen in many countries, most notably Italy, but also EMs including China and India; defaults could be contagious.

- In China, targeting growth may limit deleveraging; in Italy, the referendum may hold back plans to cut the 215 billion dollars of bad debts.

See also

- US protectionism would raise trade costs worldwide - Mar 9, 2017

- Amid many unknowns, EM assets will remain strained - Jan 10, 2017

- Angolan economy set for further tightening - Nov 22, 2016

- Prospects for the global economy in 2017 - Nov 2, 2016

- More graphic analysis