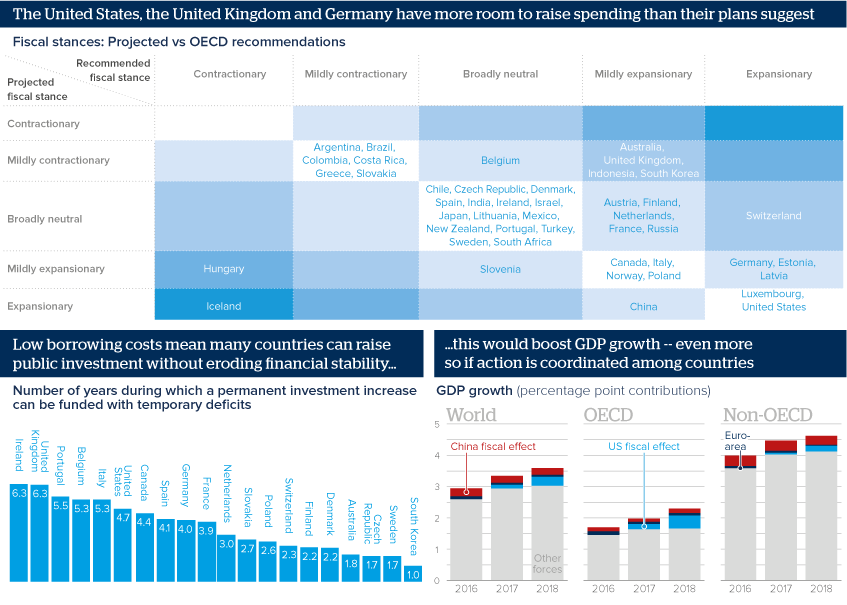

Many countries have more fiscal scope than they think

The OECD economic outlook highlights many countries that could increase public spending without endangering stability

Source: OECD Economic Outlook, November 2016

Outlook

The OECD Economic Outlook shows that productivity-enhancing fiscal initiatives will underpin the global economic recovery and that many countries have more room than they think.

Low interest rates have reduced the amount governments are spending on debt interest payments -- freeing up more than 1% of GDP from 2015-17 for the United Kingdom and around 1% for the United States. Almost 80% of the sovereign bond market in Germany and Japan is trading at negative yields -- making government spending unprecedentedly cheap.

Fiscal initiatives can be financed by temporarily issuing debt without a permanent increase in public debt ratios, as the extra debt will be paid off faster if GDP growth is higher.

Impacts

- The United Kingdom, Australia and Indonesia could spend more but UK political risk is high and consensus is low in the others.

- Infrastructure projects have a long lead time and the risks to the OECD forecast of 3.3% world growth in 2017 are to the downside.

- The link from infrastructure to productivity is not guaranteed -- other structural reforms such as labour market flexibility are key.

- Collective action among countries would have multiplier effects given trade and financial linkages -- increasing the overall growth impact.

See also

- Interest in alternative investment classes is growing - Dec 19, 2016

- Prospects for the global economy in 2017 - Nov 2, 2016

- More graphic analysis