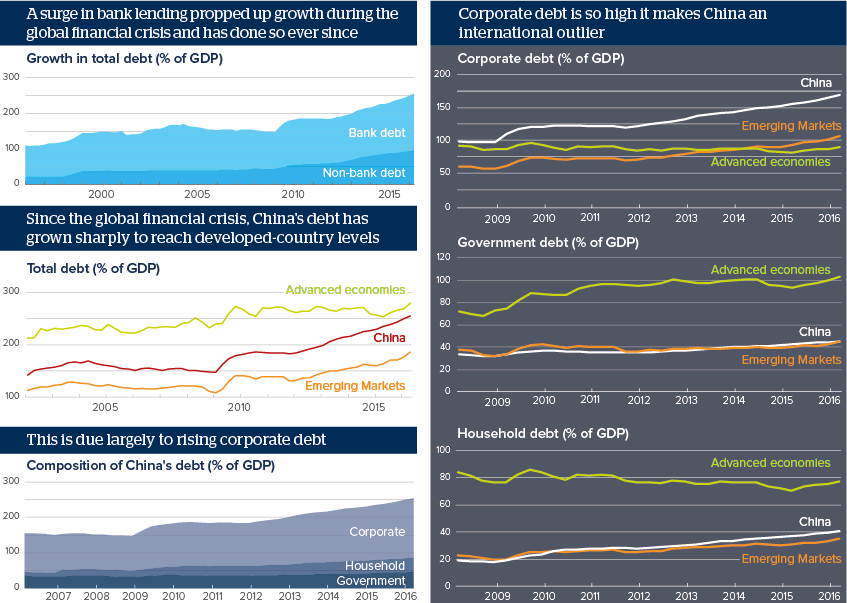

Debt burden hangs over China's economic future

Concerns are mounting about the level of corporate debt in China's economy

Source: BIS

Outlook

Debt-funded stimulus has supported GDP growth since the global financial crisis, but its effectiveness is diminishing. The scale and speed of credit growth suggest that it may become a significant drag on growth as bad loans accumulate.

Impacts

- A well-capitalised banking sector makes a financial crisis unlikely.

- A portion of corporate debt is 'disguised' public borrowing by local government shell companies; fiscal reforms will clarify the situation.

- China's relatively low level of public debt gives it the capacity to bail out banks, large firms and local governments if necessary.

See also

- Environment and technology dominate the WEF agenda - Jan 17, 2017

- Rising profitability should help to curb China's debts - Jan 10, 2017

- Curbing debt while targeting growth will test China - Oct 21, 2016

- More graphic analysis