Jebel Ali will prevail in Gulf shipping rivalry

Major port projects move ahead in Qatar, Saudi Arabia, Oman, Kuwait and the UAE

Source: World Bank, Lloyd’s List Maritime Intelligence, media reports

Outlook

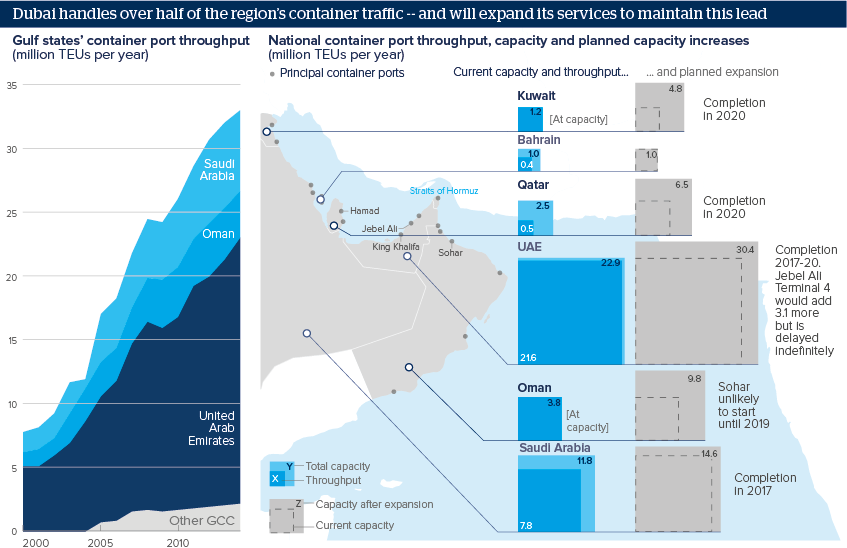

Enduring lower oil prices will push Gulf governments to diversify their economies by bolstering transhipping capacities. Port capacity in the region will expand rapidly over the next three years. Dubai's Jebel Ali will see the largest expansion, followed by Qatar's Hamad Port, Sohar Port in Oman, and King Khalifa Port in Abu Dhabi.

However, global economic growth is likely to be weak, depressing trade. Gulf Cooperation Council governments will therefore have to compete for cargo to fill their new port capacity.

Despite delays in development at Jebel Ali due to weaker economic conditions, the port will maintain its momentum as the region's leader. New ports outside the Straits of Hormuz may hold an advantage, however, offering shorter shipping routes.

Impacts

- Port capacity will outpace throughput over the next four to five years.

- Competition among Gulf states will decrease economic benefits of transhipping but may increase efficiency for importers and exporters.

- The region will be a critical entrepot for East Asian trade to Europe and Africa. In the long term, shipping will grow to fill capacity.

- Transition from oil-based bunker fuels toward natural-gas-powered vessels could afford some advantage to gas-producing Qatar.

See also

- Deepening Saudi-Emirati cooperation may be divisive - Jul 10, 2018

- Djibouti looks further east with new port deal - Mar 21, 2018

- Doha’s port fanfare points to a prolonged Gulf impasse - Sep 6, 2017

- Gulf crisis could erode Omani and Kuwaiti independence - Jul 5, 2017

- Gulf states risk overcapacity with port expansion - Jul 23, 2013

- More graphic analysis