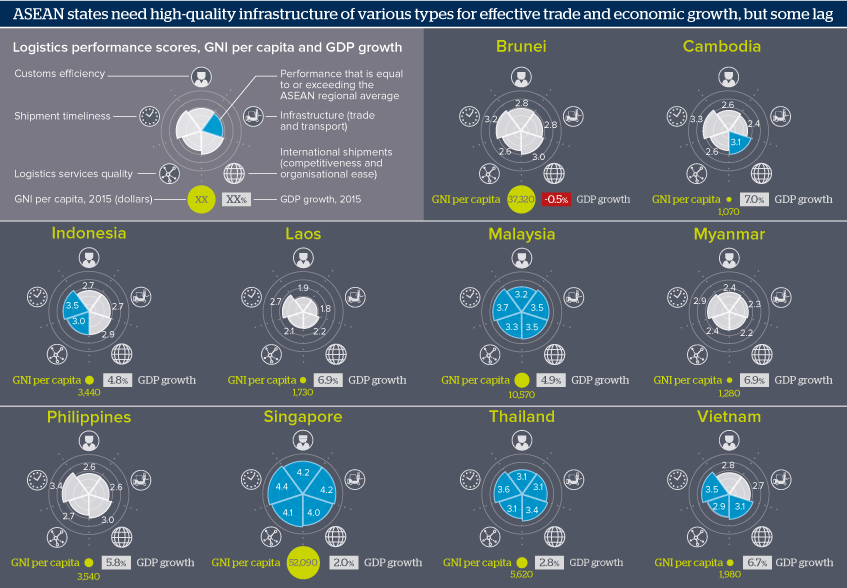

ASEAN trade needs will spur infrastructure investment

ASEAN's states do 24% of their trade within ASEAN, but infrastructure disparities are a constraint

Source: ASEAN Investment Report 2015 (ASEAN and UNCTAD); ASEAN Statistics; World Bank Logistics Performance Index 2016 (International); World Bank

Outlook

ASEAN estimated in 2015 that its ten member states need to invest at least 110 billion dollars annually to 2025 in infrastructure, including electricity (38 billion dollars), transport (55 billion dollars), telecommunications (9.2 billion dollars) and water and sanitation (7.8 billion dollars).

Now that the ASEAN Economic Community is operating, and as other bilateral and multilateral trade deals are coming, trade competition will increase between ASEAN states, and between ASEAN and the globe. Therefore, ASEAN states need effective trade infrastructure to support trade.

However, this will be easier for the wealthier ASEAN states; the poorer ones will rely on debt, donors and foreign investors, which could influence their foreign policy choices.

Impacts

- ASEAN governments will need to liberalise their infrastructure sectors to enable foreign investment.

- Aside from bridges, roads, railways and airports, investment is needed in telecommunications and computing.

- Developed infrastructure will lower business costs and could lower product prices.

- Improved infrastructure could help industrial development, including tourism and manufacturing.

See also

- New Indonesian infrastructure plans face bottlenecks - Oct 3, 2017

- Cambodian mining investment need will grow - Jul 19, 2017

- More turbulence ahead for South-east Asian airlines - Jul 7, 2017

- Laos-Vietnam trade hub prospects are unconvincing - Jun 13, 2017

- Chinese investment into ASEAN carries political risks - May 24, 2017

- ASEAN-UK trade deals hold promise, amid bottlenecks - May 19, 2017

- Philippines infrastructure needs more private money - Apr 10, 2017

- Prospects for South-east Asia in 2017 - Nov 17, 2016

- More graphic analysis