Reducing evasion is key as business taxes race lower

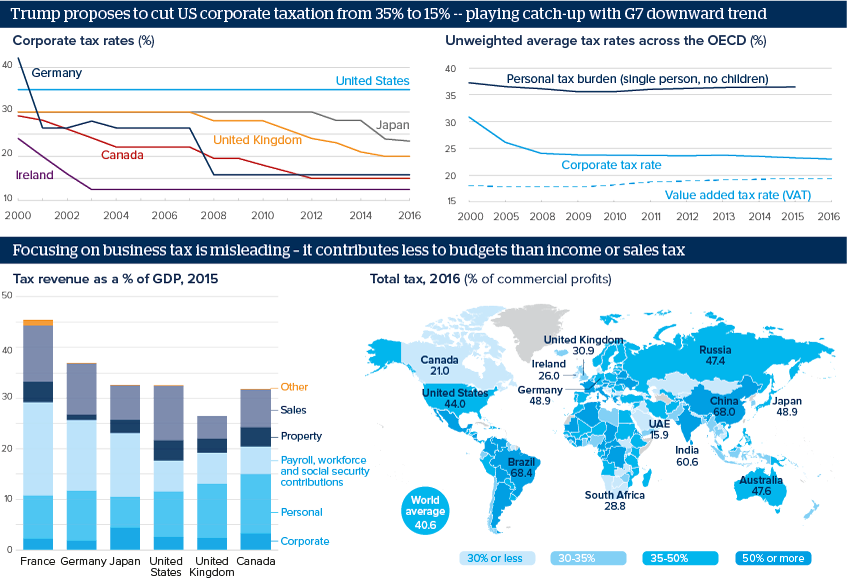

President-elect Donald Trump aims to "cut business taxes massively" as the US corporate tax rate is the G20's highest

Source: OECD Tax Database, World Bank World Development Indicators

Outlook

Other countries would likely react with their own cuts. UK corporate tax is one of the lowest in the G20 and Prime Minister Teresa May has vowed to maintain this.

Reducing tax evasion is crucial. Canada generates more revenue despite a lower corporate tax rate than the United States. The US Treasury Department estimates that the average corporate tax rate paid by firms with at least 10 million dollars of assets is actually around 20%.

A favourable tax agreement with Ireland meant Apple paid 0.05% or less on some of its foreign profits from 2003-14. The EU has ruled Apple owes 14.5 billion dollars but both parties are appealing -- Ireland doesn’t want other investors to be discouraged.

Impacts

- A lower US rate would reduce tax revenues from US firms, but would not guarantee relocation or investment by non-US firms.

- Estimates suggest each percentage-point cut in the UK corporate rate would reduce revenues by nearly 2 billion pounds (2.5 billion dollars).

- The Economic and Social Research Council claims that if Ireland raised business taxes to 13.5%, firms would be 5.0% less likely to go there.

- The EU’s lowest corporate tax rate is Hungary at 9%; widespread low rates mean that tax has a decreasing influence on a firm’s location.

See also

- Ireland will look to expand its international reach - Mar 18, 2019

- Japan’s firms will not rush to exit the United Kingdom - Mar 11, 2019

- US tax bill impact depends on how savings are invested - Feb 1, 2018

- US tax reform advantages the Republicans, for now - Dec 20, 2017

- Widespread US tax reform appears increasingly unlikely - Jun 21, 2017

- Prospects for the global economy to end-2017 - Jun 1, 2017

- Policy will not support US growth as much as expected - Apr 21, 2017

- Prospects for the US economy in 2017 - Nov 21, 2016

- More graphic analysis