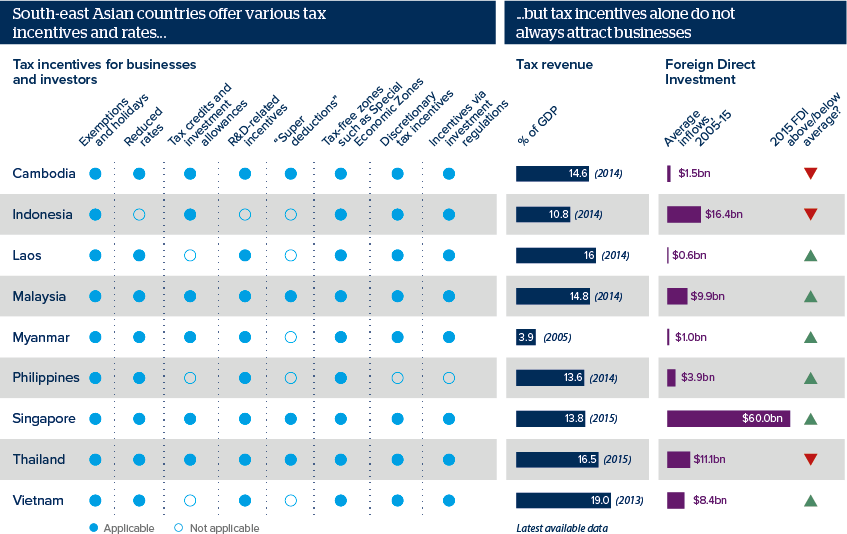

South-east Asian tax variances imply mixed outlook

As South-east Asia integrates, governments must factor tax regimes and competitiveness, and other structural reforms

Source: UNCTAD World Investment Report 2016; World Bank East Asia and Pacific Economic Update October 2015; UNESCAP; KPMG; World Bank; Oxford Analytica

Outlook

The first part of the Philippines president’s tax reform package was filed in congress on January 19. Other South-east Asian countries, including Cambodia and Myanmar, also eye tax reforms to expand the tax take and harmonise taxes with business needs.

Tax systems influence a country’s prosperity, potentially bringing new technologies, infrastructure and jobs. However, they can also cause competition, require tax rises elsewhere, and lose the state revenue. They can also take years to return socio-economic benefits. Governments need to target tax reforms at projects with wide economic benefit as ASEAN integrates economically at subnational, regional and international levels.

Impacts

- An attractive tax regime cannot substitute for a poor investment environment, including regulation or security.

- To expand their tax bases, ASEAN countries will push e-government but also need public support such as by creating redress mechanisms.

- ‘Sin’ and health-related taxes could be introduced to manage and mould public behaviour.

- Tax incentives will likely be most effective when offered to efficiency-seeking businesses, such as the mobile and export-minded.

- Discretionary tax regimes can see politics trump sound economic decision-making.

See also

- Laos’s fiscal improvement efforts will face headwinds - Nov 10, 2017

- Conservative 2018 Indonesia budget faces bottlenecks - Sep 4, 2017

- Thai infrastructure drive will seek foreign money - Aug 4, 2017

- Cambodian mining investment need will grow - Jul 19, 2017

- Philippines tax reforms could see Senate snags - Jun 20, 2017

- Philippine tax reforms will need compromise - Oct 10, 2016

- More graphic analysis