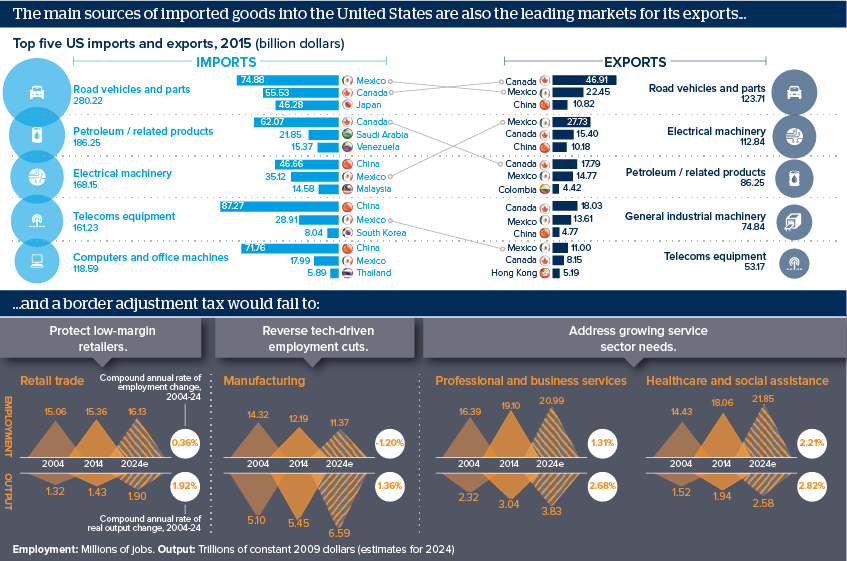

US border tax would fail to revive the ‘old economy’

Washington’s ‘America First’ symbolism is based on a political narrative of declining industries, not growth potential

Source: UN Comtrade Database, US Bureau of Labor Statistics, Oxford Analytica

Outlook

House Republicans under Speaker of the House Paul Ryan are seeking to implement President Donald Trump’s ‘America First’ trade vision by passing a border adjustment tax (BAT) scheme as part of a broader tax code reform.

While taxing imports at 20% and exempting profits from US goods sold overseas would benefit US businesses with domestic supply chains or high-value exporters, US consumers would primarily carry the costs of more expensive foreign goods.

If orthodox Senate Republicans scupper the BAT regime, the Trump White House may opt for more extreme methods of attempting to promote its economic nationalism, such as short-term import delays, bans on foreign goods and withdrawing from trade agreements.

Impacts

- Government statisticians may come under political pressure to revise ways of calculating trade data.

- The combination of OPEC supply cuts, deregulation, and a border tax scheme would prove a boon to US energy producers.

- Dollar appreciation would probably counteract any intended decline in imports from a border tax.

- Education cuts could see US students unable to fill vacancies for new jobs requiring greater training, education and interpersonal skills.

See also

- Policy will not support US growth as much as expected - Apr 21, 2017

- US protectionism would raise trade costs worldwide - Mar 9, 2017

- Anti-Mexico moves would be a net loss for US economy - Mar 6, 2017

- WTO set to remain under pressure from Washington - Feb 27, 2017

- Lower US tax receipts will crimp spending plans - Feb 23, 2017

- Border adjustment tax scheme would hit US oil refiners - Feb 3, 2017

- More graphic analysis