Car-driven Central-East European economies risk smash

Record Czech car output could go unsold if another slump in Western Europe prompts buyers to delay new car purchases

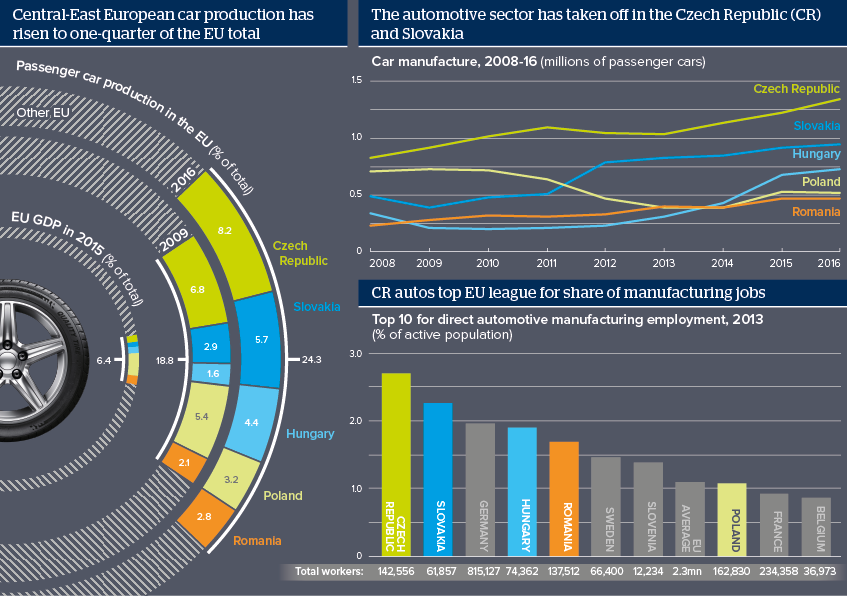

Source: European Automobile Manufacturers Association (ACEA), Eurostat

Outlook

Early 2017 data show the automotive sector in Central-Eastern Europe (CEE) on an upward trend thanks to relatively low wage costs, favourable tax regimes, skilled workers and proximity to Western Europe.

Romania apart, a self-reinforcing ‘hub’ has built up around southern Poland, northern Czech Republic, north-western Slovakia and western Hungary. Carmakers currently operating in the United Kingdom could easily move east post-Brexit, with Toyota and PSA (which is acquiring Vauxhall) already established in the Czech Republic and Hungary. Poland has lost out to neighbouring countries in terms of attracting new factories but has gone over to making parts and accessories.

However, success in attracting car-makers has a downside in that manufacturing is becoming over-concentrated on automotive, particularly in the Czech Republic.

Impacts

- The CEE auto market is small and less developed, leaving producers reliant on strong consumer demand in Western Europe.

- Inadequate transport infrastructure and weak logistics will continue to impede just-in-time delivery, if less so in Hungary and Slovakia.

- Shortcomings in CEE education systems could prove a disadvantage as the car industry globally embarks on a new cycle of innovation.

See also

- Growth outlook for 2017 improves in Central Europe - Jun 20, 2017

- VW scandal may affect investment in Central Europe - Oct 27, 2015

- More graphic analysis