Lone US Fed dove raises concerns about orderly QE exit

At the Federal Reserve meeting, Neel Kashkari voted no change and raised concern about the quantitative easing exit

Source: Thomson Reuters Datastream

Outlook

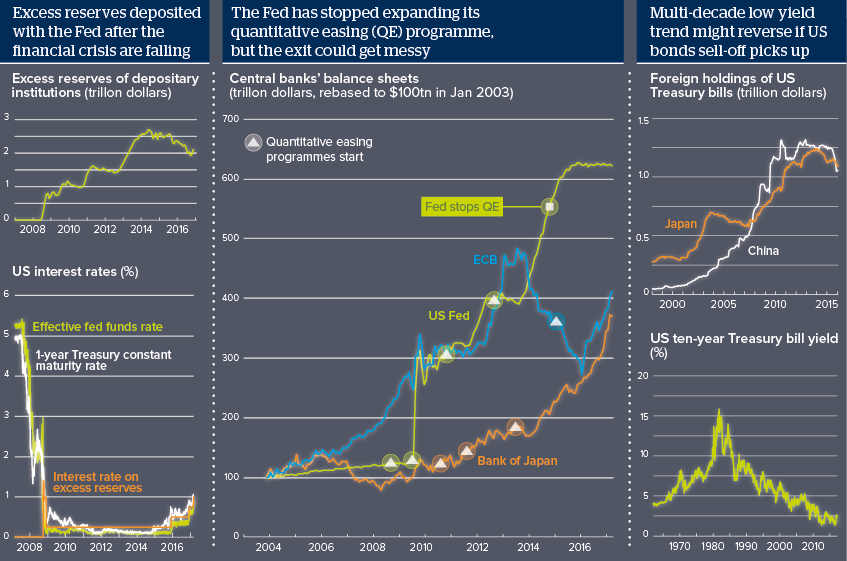

After the global financial crisis, banks deposited funds with the Federal Reserve (Fed) rather than lending them out. Other investments, notably the risk-free one-year Treasury rate, have become more attractive and Fed reserves have dropped. Kashkari, Minneapolis Fed President, has suggested the Fed publish a plan for exiting QE. Ben Bernanke, former Fed chair, says the Fed will wait until rate normalisation is well underway, thus increasing policy scope, before trimming the balance sheet.

However, Janet Yellen and Stanley Fischer are due to finish their terms as Fed chair and vice-chair in early 2018. The new team could favour a more aggressive QE exit, potentially damaging global financial stability.

Impacts

- Policy divergence, with Japan and the ECB still expanding QE, will firm up the dollar -- placing dollar-indebted emerging markets at risk.

- Secular stagnation supports low yields but China and Japan are selling US bonds -- an escalation could challenge the US equity bull market.

- Relations between the Fed and the Trump administration could deteriorate dangerously if the two criticise each other’s policies.

- In the unlikely event that Trump follows through on all his most extreme trade threats, the world could plunge into recession.

See also

- Any US Fed balance sheet unwinding may be disorderly - Jan 21, 2020

- Uneven US housing recovery is vulnerable to many risks - Jul 24, 2017

- Puzzle of Fed balance sheet progression will persist - May 17, 2017

- Policy will not support US growth as much as expected - Apr 21, 2017

- Remarkable global market stability is unlikely to last - Apr 3, 2017

- Fed hike raises risk of a politics-led market downturn - Mar 14, 2017

- More graphic analysis