Latin America tax evasion will strain state funds

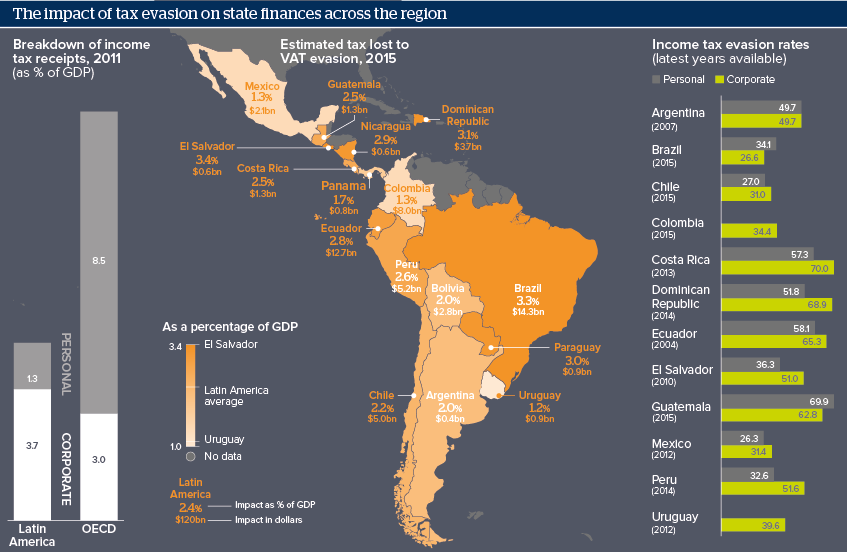

VAT evasion alone amounted to some 2.4% of Latin America’s GDP in 2015 -- roughly the region’s estimated growth for 2017

Source: CEPAL, media reports, Oxford Analytica

Outlook

Economic development and the expansion of the Latin American middle class from 2003-15 has grown the region’s potential tax base, but tax receipts remain a major problem, with evasion taking a substantial bite out of state finances.

Moreover, with informal labour still widespread, most of the personal income tax burden still falls upon a small proportion of society, reducing government funds and discouraging the notion that there is a desirable trade-off in getting better public services in return for paying higher taxes.

The need to tackle international problems such as tax avoidance, tax havens and illegal money flows may help to foster more regional cooperation. However, such cooperation could be undermined by governments’ temptation to attract foreign direct investment (FDI) through tax breaks, undercutting their neighbours.

Impacts

- Reduced US aid and tougher remittance and deportation policies may further strain state finances, worsening the impact of lost tax revenue.

- Corruption may make publics more averse to paying taxes and less willing to tolerate tax incentives as a means of attracting FDI.

- Peace processes may provide Colombia’s government with an opportunity to formalise taxation in some formerly rebel-controlled areas.

- The economic slowdown could push many people back into poverty, shrinking countries’ tax bases again.