Healthier housing dynamics would boost Chinese growth

The authorities have pledged to reduce housing oversupply and stabilise prices but the multi-speed market is a concern

Source: National Bureau of Statistics, China Index Academy, People’s Bank of China

Outlook

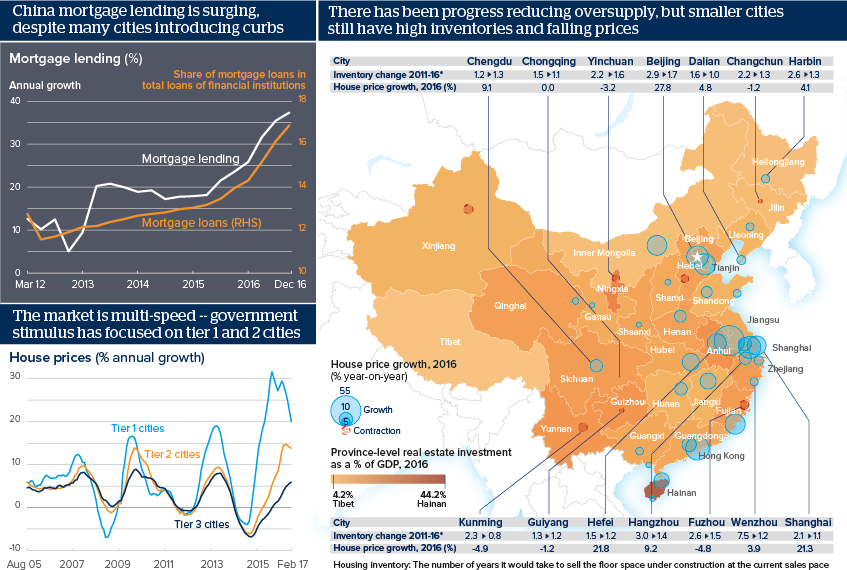

The household registration (hukou) system has focused development on the largest cities but more than half of property sales come from tier-3 cities and beyond. Moreover, the ageing population and hukou reforms mean migration is slowing.

A property slowdown seems inevitable but containable; cities increasingly restrict buyers in order to stabilise markets. However, if this reduces GDP growth in tier-3 cities and beyond, it will dampen headline growth.

The authorities must increase affordability, while protecting developers from defaulting and sparking contagion. For example, Evergrande, China’s largest developer, announced it will start paying off its debts. In 2016, its debt was 777% of equity and net profits halved on higher repayments.

Impacts

- A property tax is coming, but not in 2017 -- the vice housing minister favours it but the National People’s Congress did not discuss it.

- Tier-1 city house prices rose to 18-20 times incomes last year, more than London and raising concerns of rising social disenchantment.

- Tourism hotspots Hainan and Guizhou are very vulnerable to a slowdown as property investment accounts for 44% and 18% of GDP respectively.

- A slowdown could hit China’s 2016 33-billion-dollar property investment abroad (up 53% on 2015; the United States receives almost half).

See also

- Policies to boost China’s real estate exacerbate risks - Feb 22, 2019

- Guizhou province may grow into China's big data hub - Sep 10, 2018

- Steady housing slowdown bodes well for Chinese growth - Feb 26, 2018

- Steady housing slowdown is key to wider Chinese reform - Oct 23, 2017

- Steady China housing slowdown will encourage investors - Sep 18, 2017

- China will slowly move to target risks instead of GDP - Jul 19, 2017

- China's rural middle class will boost consumption - Mar 22, 2017

- More graphic analysis