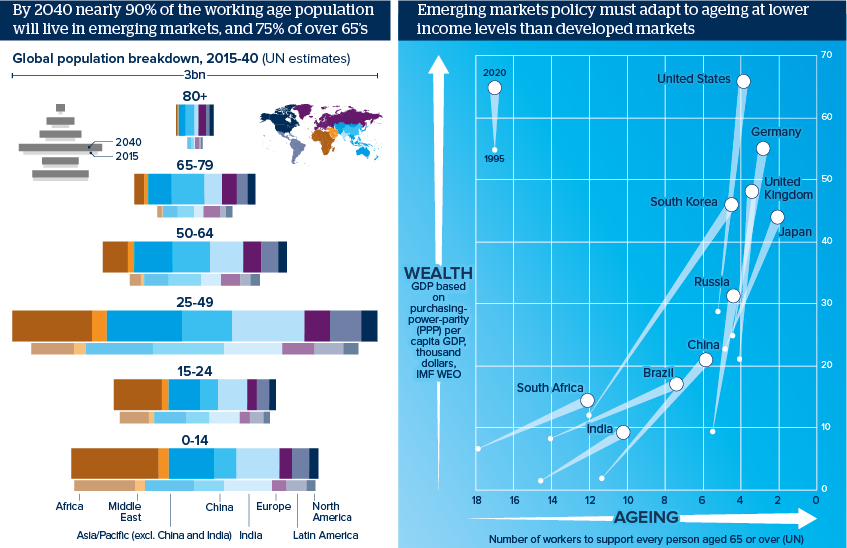

Emerging markets growing old faster than growing rich

Emerging markets are ageing at lower incomes than advanced markets, a policy challenge that will influence GDP prospects

Source: United Nations Population Prospects, IMF World Economic Outlook

Outlook

The whole world is ageing as birth rates decline and life expectancy rises. At the same time, in India and Africa, 900 million more people will reach working age by 2040, needing training, jobs, affordable housing, transport, social security, and having the political voice to demand this.

For ageing societies, retirement ages and budget costs will rise, and migration and technology will become crucial to workforce efficiency. More than one third of over 80’s will live in China and India by 2040; another 10% in Latin America.

Social spending in emerging markets will take a much larger budget share than in advanced markets, increasing debt burdens. However, adopting and sustaining appropriate polices will boost growth prospects.

Impacts

- The World Economic Forum forecasts emerging market health spending will rise at 10.0%+ a year to 2022, compared to 3.7% in advanced markets.

- Opportunities for private healthcare and leisure providers are huge in Europe and Japan; this market will emerge in developing economies.

- Technology and democracy give young populations a louder voice to campaign for resources; social unrest and populist voting may increase.

- In 2016, the Federal Reserve argued that older societies saving more will cap interest rates and investment, reducing returns and growth.

See also

- Demographic-focused policies would raise global growth - Feb 8, 2023

- Debate deepens among stagnationists and technologists - May 7, 2019

- Prospects for the global economy in 2018 - Nov 1, 2017

- Raising workers' quality is key to global productivity - Jul 4, 2017

- Prospects for renewable energy to end-2017 - Jun 26, 2017

- Ageing workforce will dampen South Korea’s GDP outlook - Apr 27, 2017

- South-east Asia’s tourism sector will need investors - Apr 4, 2017

- Global burden of non-communicable diseases will rise - Oct 17, 2016

- More graphic analysis