Kenyan rate cap may stay through the August election

Kenyan rate capping banking rule faces strong opposition

Source: Central Bank of Kenya, Bloomberg, Oxford Analytica, Reuters

Outlook

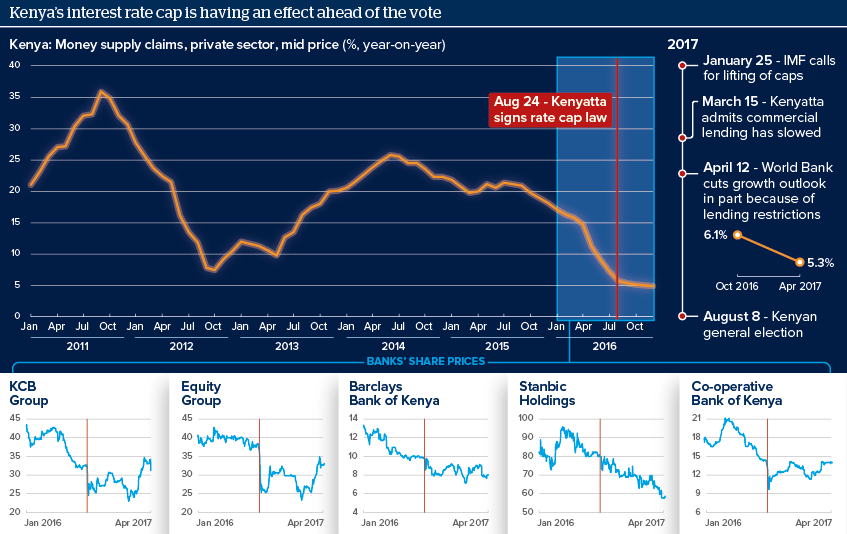

In August 2016, President Uhuru Kenyatta signed a banking law capping commercial lending at 4% above the central bank’s benchmark rate. This has drawn opposition from the country’s banks and international financial institutions, including warnings that economic growth could suffer.

The bill had unanimous support from the parliament to address what were seen as high borrowing costs. The rate cap has failed to facilitate credit to smaller enterprises; however, with the general election scheduled for August, Kenyatta may keep the cap until the vote, as it fulfils an earlier campaign pledge.

Nevertheless, the government will likely amend the law this year in response to the effects on the economy and opposition.

Impacts

- Banks will maintain lobbying efforts to have the 2016 banking law scrapped.

- Votes in the general election will be garnered through coalitions rather than voter sentiment about banking policy.

- A clear electoral victory with minimal violence, coupled with a revision of the lending law, would improve Kenya’s economic outlook.

- Other considerations -- the election, drought -- will play a role in shaping Kenya’s economic prospects over the coming year.

See also

- Partial reforms may delay Kenyan credit recovery - May 30, 2018

- Kenyan infrastructure gains will mask slippage risks - Jul 3, 2017

- Prospects for African economies to end-2017 - Jun 20, 2017

- Kenya's new banking law may spur consolidation - Sep 30, 2016

- More graphic analysis