Global house prices have firm but fragile momentum

Advanced markets’ average real house prices are almost back to the pre-2008/09 crisis peak; emerging markets’ are ahead

Updated: Oct 25, 2017

Source: Bank for International Settlements

Outlook

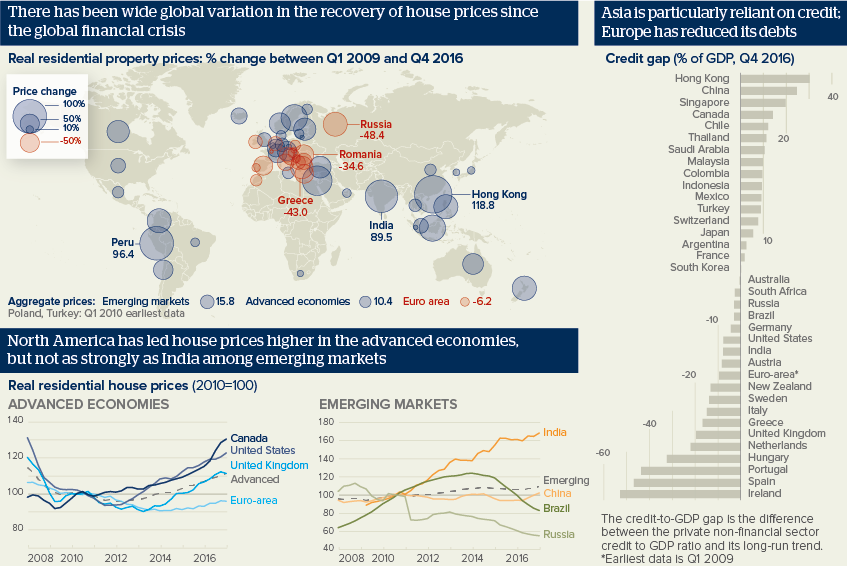

US house prices are nearing their pre-crisis peak. In Australia and Canada, prices have risen beyond 2007’s. In the euro-area, prices remain 10% below their pre-crisis peak.

In emerging markets, prices have risen 14% beyond the pre-crisis peak, led not by China, where prices have risen by 10% since the crisis, but by India, up 90%. Malaysian and Philippine prices have gained 50%; Turkey and Peru more than 40%. In Russia, prices have halved since 2009. Brazilian prices have resumed falling since 2014.

In India, Australia and Sweden, house prices have risen as fast as in East Asia, despite less credit reliance. China, Hong Kong, Singapore, Malaysia, Thailand and Canada are vulnerable to higher interest rates.

Impacts

- There is consensus that higher house prices encourage consumption though less certainty over how the factors driving both are modelled.

- Working age populations are falling and interest rates are low; the debate over inequality and intergenerational transfer will intensify.

- In India and Africa, 900 million more people will be working age by 2040, needing affordable homes, jobs, transport and social services.

- Technology and democracy give young populations a louder voice to campaign for resources; social unrest and populist voting may increase.

See also

- New Zealand will curb foreign property investment - Oct 25, 2017

- Prospects for the US economy to end-2017 - Jun 28, 2017

- Prospects for the global economy to end-2017 - Jun 1, 2017

- More graphic analysis