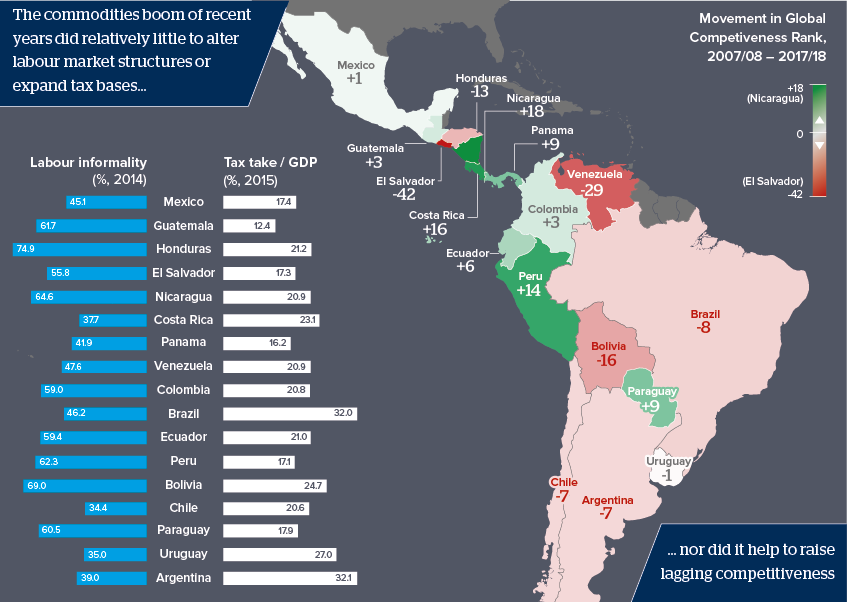

Informality crimps Latin American options

The large informal sector reduces fiscal revenues and with them options to improve services and competitiveness

Source: World Economic Forum; OECD; ECLAC; Oxford Analytica

Outlook

Competitiveness rankings for Latin American countries do not entirely correlate with the size of their informal sectors, but the relative inefficiency of informal economies and their impact on fiscal revenues work through to factors affecting competitiveness, including education and productivity.

The reduction of the tax base implicit in the informal economy also increases governments’ revenue dependence on sectors whose performance is highly variable -- notably extractives.

Limited revenue options and attractiveness to investors risks driving more regional governments to debt-taking to cover spending.

Impacts

- Given poor service quality, companies and workers have little incentive to pay more taxes, limiting their desire to join the formal sector.

- Poor service quality in areas such as education, in turn, makes it more difficult to escape the low competitiveness trap.

- The reduced number of contributors to social security systems will have an increasingly explosive impact as populations age.

See also

- Latin America informal labour brings benefits and woes - Oct 4, 2019

- Inefficiencies will force austerity in Latin America - Sep 24, 2018

- Latin Americans' hopes will challenge their leaders - Oct 30, 2017

- Labour informality may increase in Latin America - Nov 15, 2016

- More graphic analysis