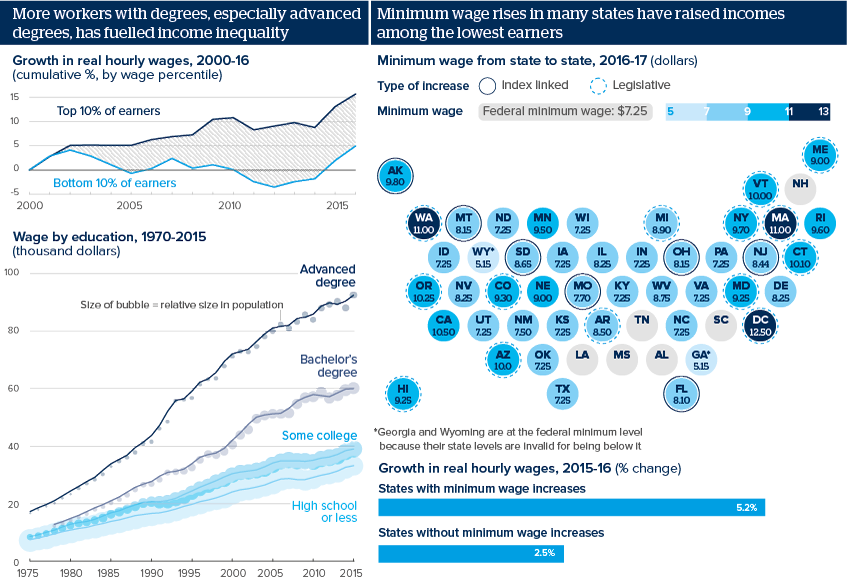

Regressive tax bill may offset rising US minimum wages

Minimum wages rose in 22 states in 2017, adding impetus to rising wages for the lowest earners after years of stagnation

Source: Sources: Economic Policy Institute, National Conference of State Legislatures, US Census Bureau

Outlook

Fuelling inequality, real wages for high school leavers or those with some college education have grown by only 1.7% and 2.6% in 40 years, whereas those with bachelor’s and advanced degrees have grown by 17% and 22%. Minimum wage increases across almost half of states since 2015 have started to close this gap. In 2016, the wages of the lowest 10% of earners rose twice as fast in states that raised the minimum wage than in those that did not.

Having grown over decades, the gap remains wide. The new tax bill, which Congress may vote on next week, could sap consumer spending as it removes some tax deductions for professionals and raises costs for low-wage and self-employed workers. Health premiums for individuals will rise by 10% each year.

Impacts

- A 2016 study finds US intergenerational mobility is 20% lower if grandparents and great grandparents are included as well as just parents.

- Research finds only 50% of those born in the 1980s will earn more real wages than their parents whereas 90% of 1950s births earn more.

- Mobility varies; North Dakotans have a 20%+ chance of rising from the lowest 20% of incomes to the top. In the South-east, this is halved.

- If the lowest wages keep rising, buoyed by state minimum wage rises, this could increase the chance of Donald Trump winning a second term.

See also

- Prospects for the US economy in 2018 - Nov 28, 2017

- More graphic analysis