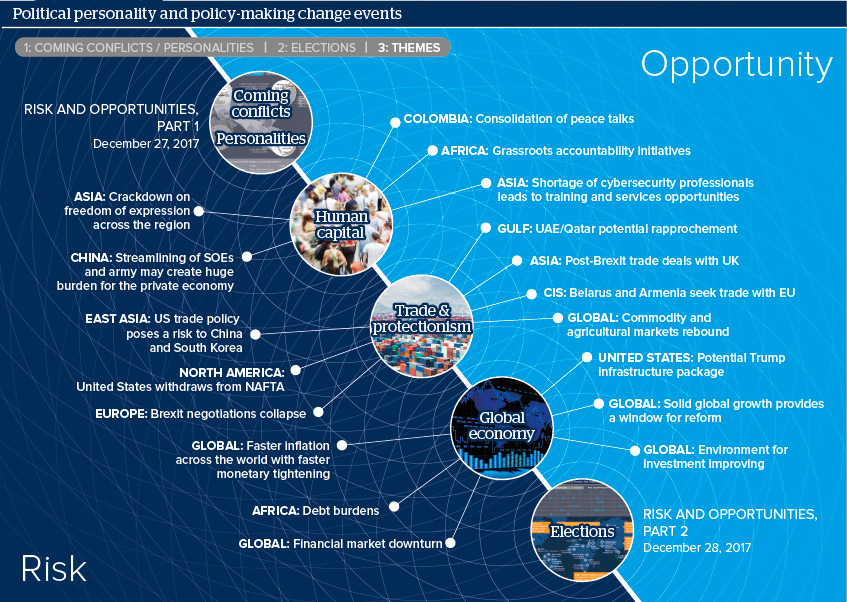

Risk and Opportunities, 2018, Part 3

Risks mostly ignored by investors in 2017 will move front-of-mind in 2018

Source: Oxford Analytica

Outlook

At close to 4%, the world economy will grow in 2018 at its fastest pace since 2010. Should any of the political hotspots from North Korea to the Middle East erupt, investors will be in no position to be as sanguine about geopolitical risk as they were in 2017.

The era of cheap money that underpins that expansion (and frothy equity markets) is ending. Central banks, led by the US Federal Reserve, will ‘normalise’ monetary policy. The risks lie in misjudgements of the pace of rate rises, and investors over-reacting in response, inflation triggering a bond-sell off, particularly in Europe, and a stronger dollar stressing holders of high levels of dollar-denominated debt are particular risks.

Impacts

- An edgy status quo will prevail over North Korea with conflict unlikely but still possible, especially if there were a US strike.

- President Donald Trump’s conflation of good relations with other leaders as good bilateral relations overall risks policy stumbles.

- Despite loss of territory, Islamic State is not defeated but will morph into a traditional terrorist organisation.

- Crown Prince Mohammed bin Salman’s rewriting of the Saudi social contract regardless of existing patronage networks raises stability risks.

- Protectionism in services in the name of national security is a greater risk to global trade than in merchandise trade.