Multiple risks threaten Nigeria’s economic recovery

Political and security risks will overshadow Abuja’s attempts at a rebound

Source: Thomson Reuters Datastream, ACLED (Armed Conflict Location & Event Data Project), media reports, Oxford Analytica

Outlook

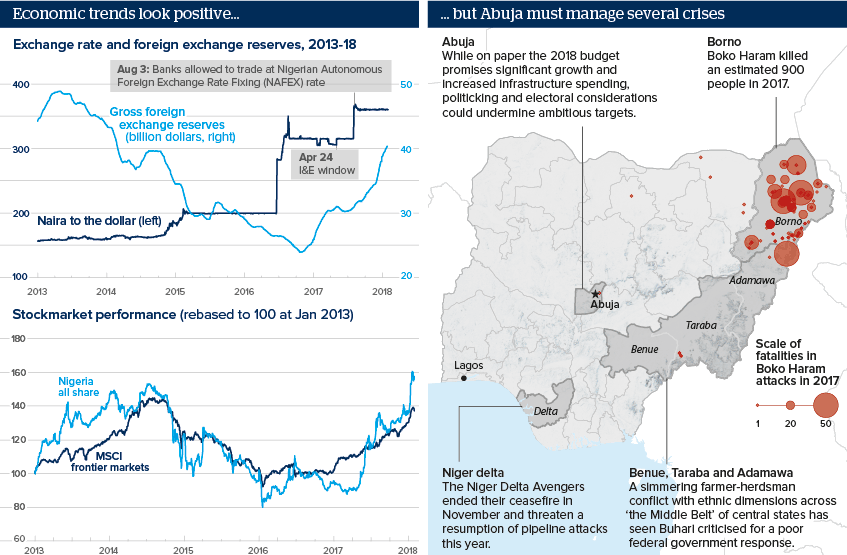

The Nigerian stock market is the world’s best performing this year. Coupled with a relative stabilisation of the naira, this has given Abuja confidence that it can fulfil ambitious growth targets in the Economic Recovery and Growth Plan (ERGP) after the recent recession.

However, risks abound prior to the 2019 elections, including a resurgent Boko Haram threat in the north-east, a pastoralist conflict in the ‘Middle Belt’ of central states and a potential resumption of Niger Delta pipeline attacks.

Furthermore, ongoing tension between the presidency and the senate has seen a recent meeting of the central bank’s monetary policy committee cancelled, raising concerns over fragile naira stability. This comes amid continued internal ruling party concern, as well as public criticism, over President Muhammadu Buhari's poor handling of the economy.

Impacts

- A failure ignificantly to increase non-oil revenues in the short term could undercut the ERGP’s credibility.

- Short-term debt servicing costs will pose a significant risk to Nigeria’s balance sheet.

- Infrastructure gaps will hinder larger growth projections and diversification efforts.

- Calls for greater national reconstruction and regional devolution will mount ahead of the election.

See also

- Nigerian naira will stay static despite high oil price - May 25, 2018

- Boko Haram abductions will undermine Nigeria’s Buhari - Feb 26, 2018

- Nigerian pastoralist conflicts could worsen - Feb 20, 2018

- Nigeria’s infrastructure backlog could worsen - Dec 22, 2017

- More graphic analysis