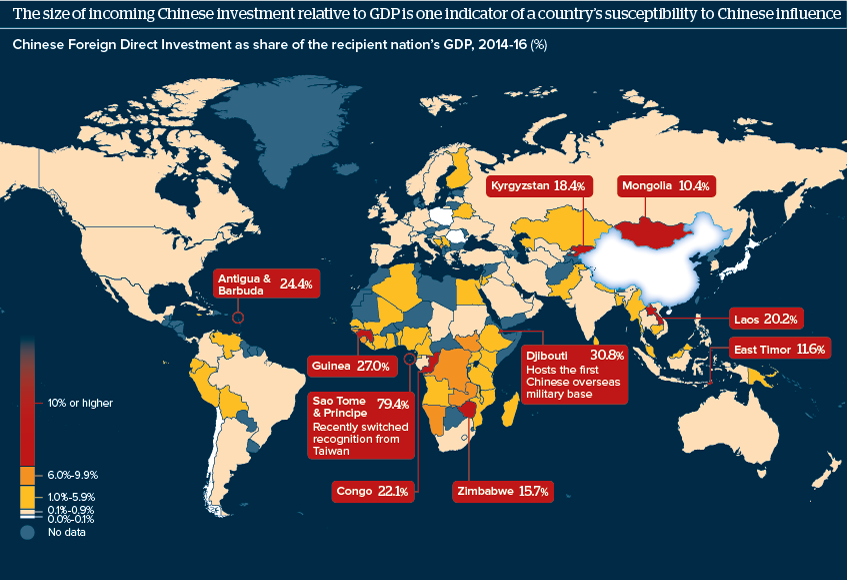

Chinese overseas investment carries varying weight

As China's investment overseas grows, so does its potential for political leverage over host countries

Source: China Global Investment Tracker, World Bank

Outlook

China will try to translate its economic leverage into political compliance on key international issues that affect it. However, investment will not automatically confer leverage in practice; the salience of issues to both sides also matters, as does the relative influence of third countries.

On the other hand, China’s leverage could be disproportionately strong if a country’s key export goes to China, a key import comes from China or GDP per capita is low. China’s influence will be greatest in small, poor economies, as seen in its poaching of Taiwan’s diplomatic allies.

Impacts

- Overall, Africa is the region most susceptible to Chinese influence by this measure.

- Except for outlier Kyrgyzstan, the Belt and Road countries are not yet especially susceptible to Chinese economic leverage.

- China’s leverage by this measure is particularly high in South Asia; India may try to counter this.

- Japan and South Korea have among the lowest dependence, supporting their persistence with policies that Beijing strongly opposes.

See also

- Central Asia faces debt risk alongside Silk Road gains - Apr 10, 2018

- Belt and Road paves way for China’s new global role - May 18, 2017

- More graphic analysis