China-US intellectual property tension will intensify

The United States and China are at opposite ends of the intellectual property spectrum -- setting the scene for friction

Source: World Bank World Development Indicators; IMF World Economic Outlook, April 2018; US Bureau of Economic Analysis

Outlook

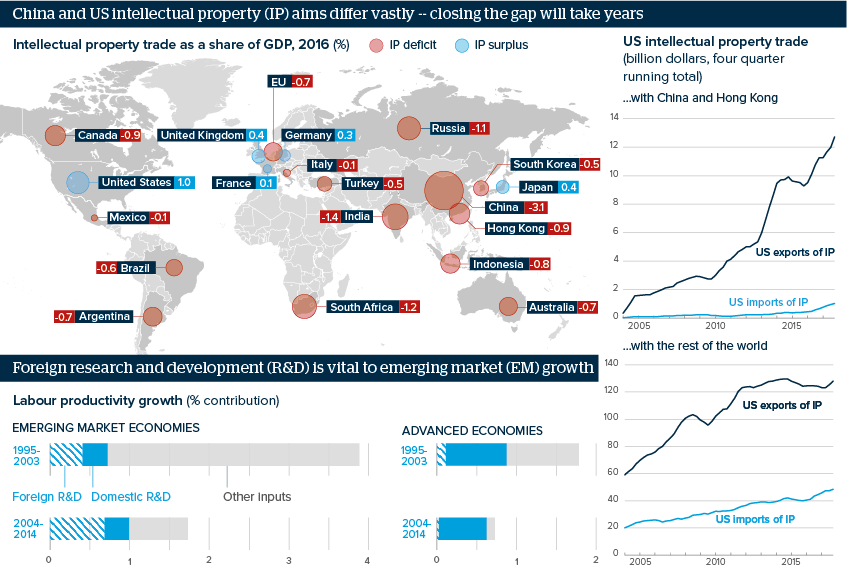

China runs a deficit of 3.1% of GDP in IP trade, more than double any other G20 economy. The US surplus of 1.0% of GDP is also more than double any other G20 nation. China benefits from lighter rules but, keen to protect their country’s strength, US legislators desire tougher rules.

An escalation of technology transfer restrictions would dampen EM growth. The IMF estimates that foreign R&D contributed 39% of EM labour productivity growth in 2004-14 and domestic R&D less than 20%. Domestic R&D contributed more than 80% of advanced markets’ labour productivity growth.

The WTO agreement on Trade-Related Intellectual Property Rights could be enhanced and supplemented by bilateral treaties.

Impacts

- A US clampdown will slow not stop growing US IP exports to China and Hong Kong, up tenfold on 2000 at more than 10 billion dollars in 2015.

- South Korea cut its IP deficit to 0.5% of GDP in 2016 from over 10% in 1996; if globalisation has ‘peaked’, China will struggle to do this.

- US ire over IP theft is self-defeating; supporting EM growth prospects sustains a surging market for US exporters to sell into.

- Canada runs a large deficit in US IP; this could be the trickiest area to agree on in the North America Free Trade Agreement negotiations.

See also

- Extended tariffs may push a US-China deal beyond 2020 - Aug 13, 2019

- China-US tensions risk unravelling tech value chains - Jan 3, 2019

- US tariffs and trade confusion to persist post polls - Oct 24, 2018

- NAFTA moves imply more US-China trade conflict - Sep 3, 2018

- ZTE thaw shows the balance of power lies with US tech - Jul 12, 2018

- Neither Beijing nor Washington will budge on tariffs - Jul 11, 2018

- Prospects for emerging economies to end-2018 - Jun 27, 2018

- US tariffs will test trade alliances and architecture - Jun 18, 2018

- US/China self-sufficiency drives could cut world GDP - Apr 4, 2018

- More graphic analysis