Tajik and Kyrgyz push for loans ignores risks

Governments in Kyrgyzstan and particularly Tajikistan are giving little thought to the future debt repayment burden

Source: Tajik and Kyrgyz finance ministries; 24.kg; Asia-Plus; Avesta; Sputnik; National Bank of Kazakhstan; IMF; World Bank; Bank for International Settlements; Oxford Analytica calculations.

Outlook

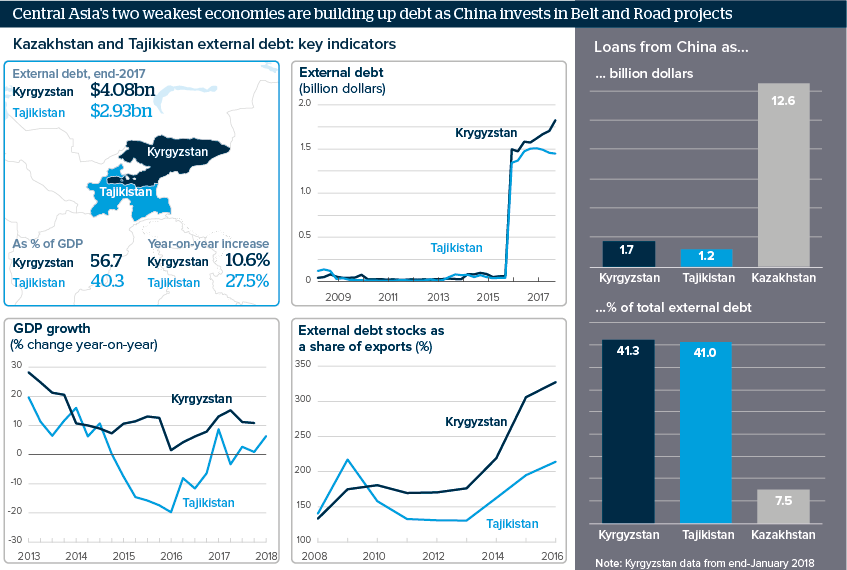

China has been lending heavily to Central Asian states for transport and other infrastructure relating to its Belt and Road Initiative, but also energy and industrial projects.

The weakest states, Tajikistan and Kyrgyzstan, are accruing new debt at alarming rates; the bulk of it is Chinese. Neither has oil or gas, unlike wealthy Kazakhstan, and there are concerns that economic benefits from debt-funded development will not come fast enough to ease the pain of repayment.

The IMF and World Bank have warned of the dangers of future debt distress and there is domestic discussion, particularly around fears that governments will cede assets, even land, in lieu of payment.

Impacts

- Kazakhstan has a much higher debt-to-GDP ratio but comparatively little Chinese debt and better repayment prospects.

- Russia has written off 490 million dollars of Kyrgyz debt since 2012 to seal a political rapprochement; China will not be so generous.

- Tajikistan is considering a second 500-million-dollar bond issue after a similar offering in September 2018.

- With more loans to come, Kyrgyzstan plans to raise the official debt-to-GDP ratio limit from 60% to 70%, and Tajikistan from 40% to 60%.

See also

- Kyrgyz growth is hostage to gold and remittances - Oct 29, 2019

- Tajik-Iran ties may improve but without old closeness - Jun 7, 2019

- Prospects for the Belt and Road Initiative in 2019-23 - Dec 7, 2018

- Central Asia faces debt risk alongside Silk Road gains - Apr 10, 2018

- More graphic analysis