Weak lira will hurt pre-election Turkish economy

Accelerating lira weakness makes imports more expensive and pushes up inflation just as Turkey heads for early elections

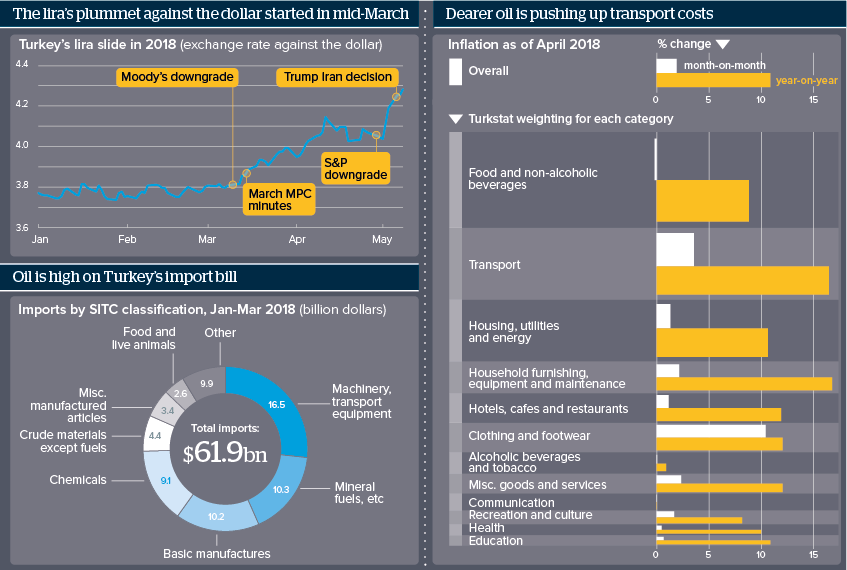

Source: Turkish Central Bank; Turkstat

Outlook

US President Donald Trump’s decision to pull out of the 2015 multilateral Iran nuclear agreement has brought world oil prices to late-2014 levels. Much of Turkey’s energy comes from Iran. It imports more than it exports, particularly oil; lira depreciation means it is also importing inflation.

The latest bout of lira weakness began in March, with a spate of unfavourable current-account and inflation data and a revised electoral law encouraging speculation about early elections. The Central Bank only responded in April, with its first (modest) rate rise of the year. This has depressed Turkey’s credit ratings further into ‘junk’ status. Both the geopolitical and the domestic environments are uncertain; snap elections are being held in June.

Impacts

- The government may have seen an economic downturn coming and called early elections in April hoping to get ahead of it.

- Further lira weakening will test Central Bank ingenuity in responding, as the government pushes for cheaper credit.

- Turkey’s already wide current-account deficit will widen further.

- Dollar appreciation is making it harder for Turkey to attract short-term capital and service its private-sector foreign-denominated debt.