Ghost of crises past raises Argentine vulnerability

Both domestic and international investors are easily shaken by economic tremors in crisis-prone Argentina

Source: Argentine Central Bank; INDEC; Oxford Analytica

Outlook

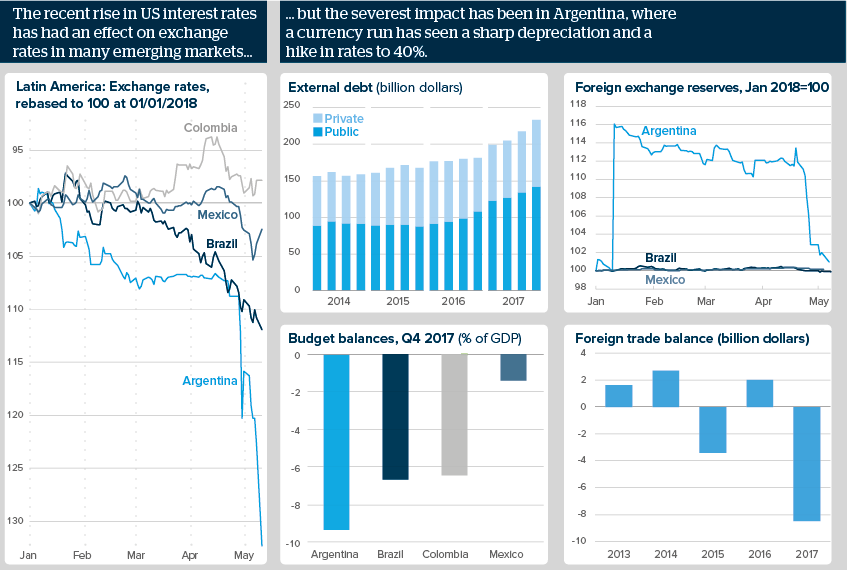

The impact on Argentina is in large part due to the web of difficulties faced by the economy -- trade and fiscal deficits, and the heavy dependence on foreign debt to finance them; sluggish growth and investment; and mutually exclusive fiscal and monetary priorities.

Above all, however, it reflects lingering concerns over economic stability, both domestically and abroad. At the first sign of volatility, already fragile domestic confidence is ready to plummet, in turn feeding economic worries.

A key indicator will be whether investors are willing to renew the nearly 650 billion pesos (26.2 billion dollars) of Central Bank notes due this week -- 55% of the total.

Impacts

- The decision to seek a deal with the IMF, far from soothing nerves, has fed domestic fears that a new crisis cannot be far behind.

- New debt requirements and repayments due this year may encounter greater obstacles than in the past two years.

- Efforts to cut the fiscal deficit will undermine growth, already hit by the drought affecting agriculture.

- The social impact will undermine the government in advance of 2019 elections, potentially reinforcing economic concerns.

See also

- IMF deal will have mixed impact in Argentina - May 21, 2018

- Argentine debt rollover eases pressure temporarily - May 16, 2018

- The dollar will determine emerging market asset moves - May 16, 2018

- Argentina currency crisis highlights policy vacuum - May 4, 2018

- More graphic analysis