Debts could crimp growth prospects in emerging markets

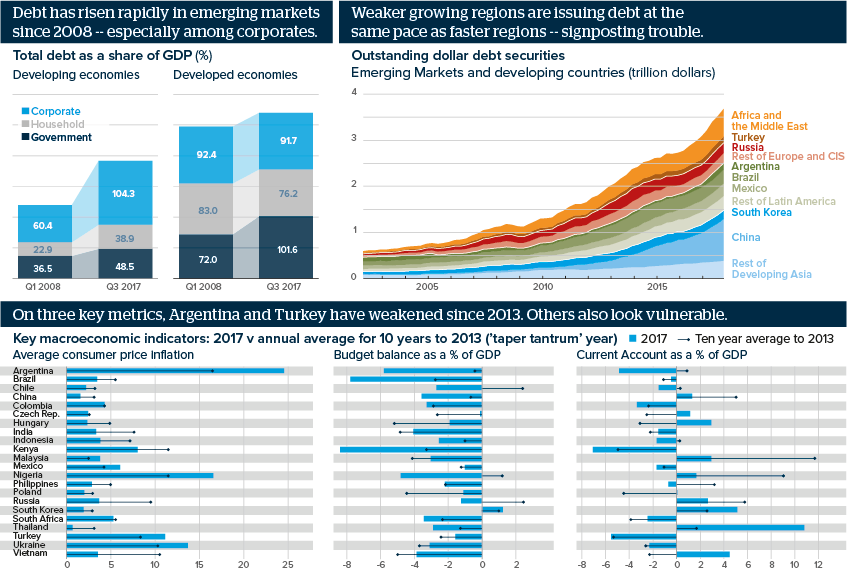

Debts issued by emerging markets have surged since 2008 and concerns are rising now monetary conditions are tightening

Source: Bank for International Settlements, Thomson Reuters Datastream

Outlook

Ten years of ultra-loose monetary policy have encouraged unprecedented debt accumulation.

Corporate debt accounts for 104% of emerging markets GDP, from 60% in 2008. In China, it is 162.5% of GDP. In Turkey, Mexico and Indonesia it has nearly doubled or more. As monetary conditions tighten, funds will be diverted from productive investment towards costlier interest payments, dampening potential growth.

Emerging markets household debt has doubled from 23% of GDP to near 40%. It is more than 66% of South Korean, Thai and Malaysian GDP and has almost doubled or more in China, Russia, Turkey, and Poland. As well as constraining spending, indebtedness could accentuate political polarisation, reducing reform implementation.

Impacts

- EM fundamentals are stronger -- price stability gives scope to adjust rates steadily while better balances and more reserves reduce risks.

- Turkish reserves cover just 90% of debts due in 2018; in Argentina, Malaysia and the Ukraine, reserves are close to the ‘safe’ 100% ratio.

- Banks have lent out more than they hold in deposits in Turkey, Mexico, Colombia, Chile and South Africa -- raising banking sector risks.

- Foreigners own 50%+ of South Africa’s government bonds, 40% of Indonesia’s and 30% of Malaysia’s -- this liquidity raises sell off risks.

See also

- Prospects for emerging economies in 2019 - Nov 6, 2018

- Emerging market investors selectively search for yield - Oct 5, 2018

- Tighter money conditions could cause multiple shocks - Aug 24, 2018

- Dollar funding squeeze will threaten indebted nations - Jul 19, 2018

- Prospects for emerging economies to end-2018 - Jun 27, 2018

- The ECB will set the speed of global credit tightening - Jun 15, 2018

- Low monetary credibility keeps strain on Turkish lira - May 30, 2018

- Prospects for the global economy in 2018 - Nov 1, 2017

- More graphic analysis