Rising debt will expose Africa to interest rate shocks

Debt has risen to dangerous proportions; costlier payments will constrain indebted countries as monetary policy tightens

Source: IMF, World Bank, Oxford Analytica

Outlook

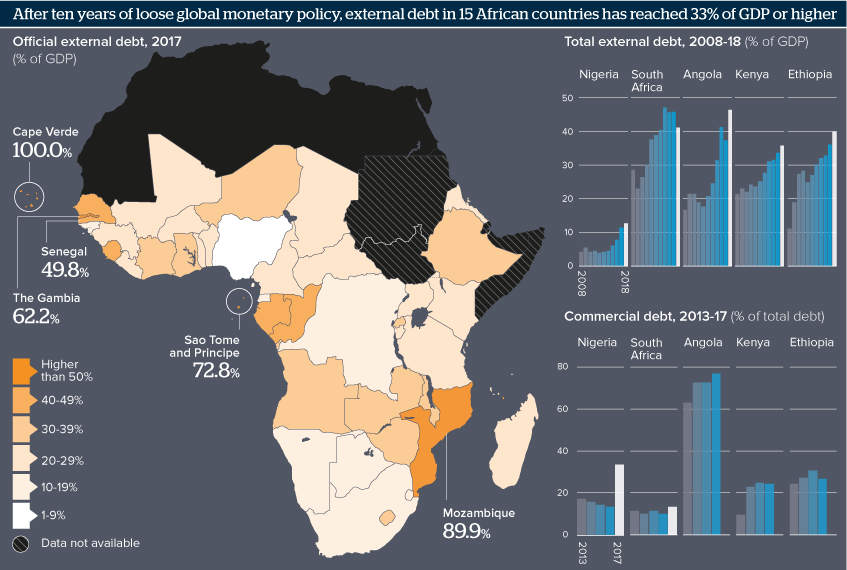

The IMF and World Bank have issued recent warnings over Africa’s rising debt levels. Sustained low interest rates since 2008 have encouraged borrowing; in this time, median African debt-to-GDP levels have more than doubled, surpassing 50% in 2016.

At least 15 countries are now either in or on the verge of debt distress, which means they are struggling to service their debts. Among these is Ethiopia, one of Africa’s five big economies, upon which regional growth and industry depend heavily.

Debt is also rising in the other big economies -- Angola, Kenya, Nigeria and South Africa -- raising spill-over risks for surrounding dependent economies. Each is also taking on more commercial debt, which tends to be more expensive and pursued more aggressively by creditors than concessional debt.

Impacts

- Instances of misreporting of debt such as in Mozambique will raise concerns of higher-than-anticipated debt (such as in Zambia).

- Countries such as Kenya and Djibouti that owe more than two-thirds of their external debt to China may be exposed to political leverage.

- Poor returns on debt-financed infrastructure are likely to persist unless new appetite for genuine reform emerges.

- Record demand for African Eurobonds could subside, limiting their utility for debt-service financing.

See also

- Prospects for African economies to end-2018 - Jun 8, 2018

- Thirst for African Eurobonds belies higher credit risk - Apr 10, 2018

- More graphic analysis