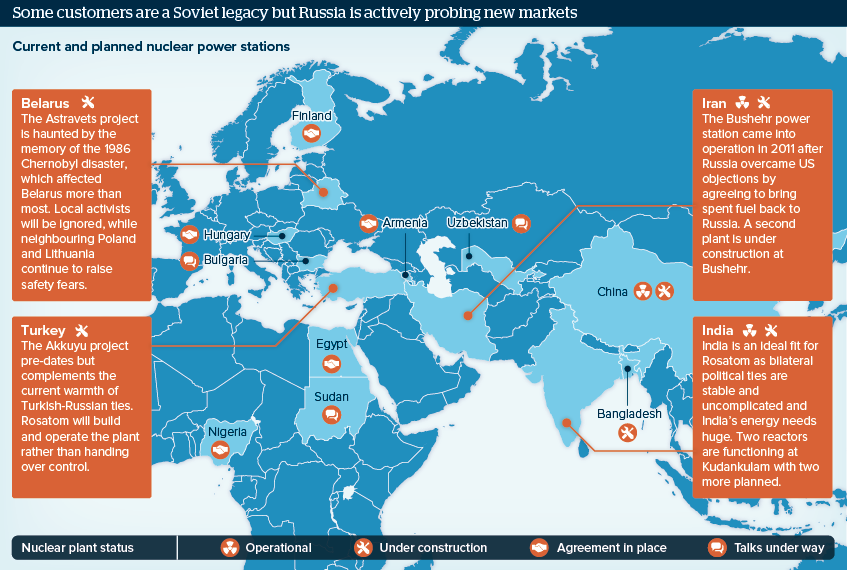

Russia pushes to expand nuclear plant sales

Rosatom has had most success in Iran, China and India but is seeking other buyers for its nuclear plant technology

Source: Rosatom; World Nuclear Association; Bellona

Outlook

Nuclear power agency Rosatom allows the Kremlin to project influence abroad over the long life of contracts, but also brings large commercial rewards.

Rosatom says it is world leader for the number of reactors built abroad and at end-2017 had 33 more under construction. It has benefited from troubles affecting other major players: France’s Areva has needed a bailout and the US firm Westinghouse filed for bankruptcy in 2017.

Rosatom belongs to a state with large uranium reserves and the ability to offer loans as incentives to purchasing countries. Its ability to provide construction, fuel and eventually decommissioning allows for flexible options, from complete Russian management (Turkey) to partial local construction (India).

Impacts

- China will emerge as a major competitor to Rosatom by offering a range of reactor types and granting similar attractive financing deals.

- Rosatom will target countries where concerns sparked by the 2011 Fukushima disaster are absent or muted.

- It will face setbacks even in these markets: Vietnam, South Africa and Jordan have all pulled out of nuclear plant agreements.

- The two reactors Rosatom offers are far advanced from the Chernobyl plant; the latest VVER-1200 is certified to post-Fukushima standards.

See also

- Belarus goes nuclear despite neighbours' unease - Feb 11, 2021

- 'Mercenary' arrests derail Belarus-Russia ties again - Aug 6, 2020

- Inventory overhang will cap uranium price gains - Jan 22, 2020

- Controversial Belarus nuclear plant to start in 2020 - Oct 10, 2019

- Vietnam’s rising energy imports will spur deregulation - Mar 27, 2019

- Russia will try to expand influence in South-east Asia - Jul 17, 2018

- Russia's nuclear plans match profit with politics - Jul 16, 2018

- Nuclear energy will diversify Middle Eastern ties - Jul 4, 2017

- More graphic analysis