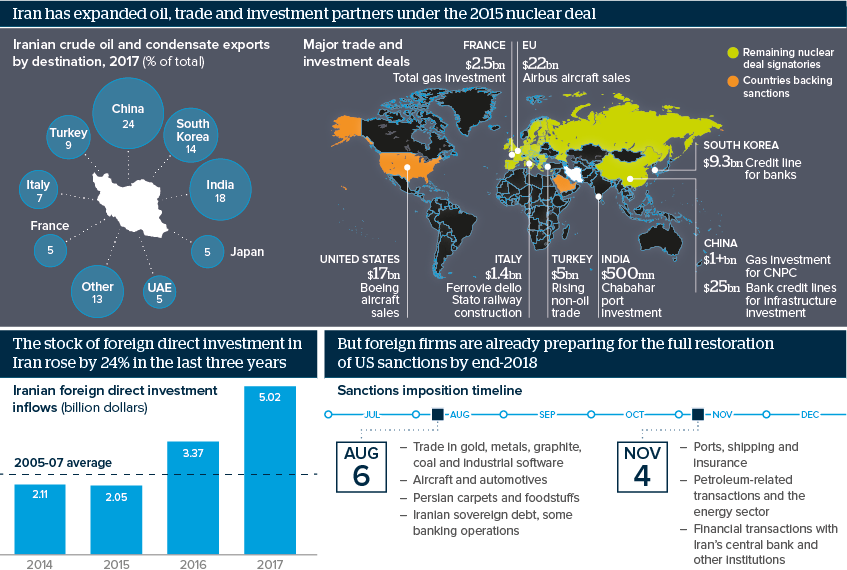

US sanctions will increase Iran’s dependence on China

A resurgence in global investment deals and oil exports after the 2015 nuclear agreement has left Tehran vulnerable

Source: EIA, UNCTAD, OFAC, International Crisis Group, media reports

Outlook

Iran’s currency is plummeting based on local speculation about the impact of returning sanctions. Further protests are expected as imports are restricted and inflation begins to rise.

Despite its commitment to the nuclear deal, the EU has little scope to protect Iran from the impact of US withdrawal. Big European firms will tend to prioritise US interests. Before the breakdown, fear of US sanctions was cited by 57% of managers as the main reason that multinationals were slow to trade with and invest in Iran.

The result will be increased dependence on China -- and, to a lesser extent, India -- as oil purchasers and investment partners. Beijing could leverage this to win more favourable deals.

Impacts

- South Korea, Iran’s third-largest oil importer, has already signalled it will end contracts; Japan is nervous.

- Suffering from its own sanctions, Russia will maintain ties with Iran, but it is not a major trade or investment partner.

- Turkey may seek to evade sanctions on significant oil, gas and other trade, but will limit expansion plans.

- Oman, Kuwait and Dubai will see big losses if economic ties are blocked, despite Gulf Arab political consolidation against Iran.

See also

- Prospects for Iran to end-2018 - Jun 29, 2018

- Washington’s pressure on Tehran may miss the mark - Jun 27, 2018

- Partners will struggle to save the Iran nuclear deal - May 9, 2018

- More graphic analysis