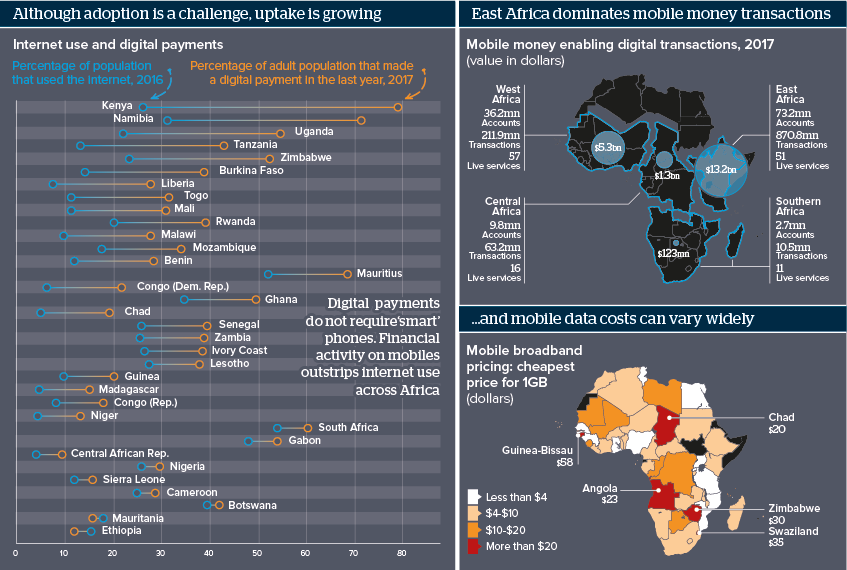

Africans will increase digital payment use

Digital transactions are on the rise, even where internet access lags

Source: International Telecommunication Union (ITU); World Bank; Hootsuite and We Are Social ‘Digital in 2018 report’, GSMA Intelligence ‘The Mobile Economy Sub-Saharan Africa 2018’; Research ICT Africa

Outlook

The number of Africans making a digital payment in the last year, on any digital device, has grown significantly.

For much of Sub-Saharan Africa, this share is larger than those with access to the internet. Phone sharing and the use of SMS explain much of the difference. Conversely, in other developing regions or emerging economies, there are many more people online, but they are not digitally transacting.

Regional mobile subscriber penetration still lags global trends, but monetary crises, as well as the lack of formal banking facilities, will see cash increasingly bypassed and new fintech options embraced.

Impacts

- With mobile money markets notoriously unregulated, several states may look to cap fees or tax transactions (eg, Uganda).

- Public pressure will grow on governments (eg, South Africa) and regional economic blocs to lower and harmonise mobile data costs.

- Mooted use of mobile money for social grant payments in South Africa could prompt broader Southern African uptake.

See also

- Digital currencies hold much promise for central banks - Apr 20, 2020

- Africa's e-commerce players must overcome hurdles - Jul 18, 2019

- Social media will be key Nigerian poll battleground - Sep 28, 2018

- Improved African infrastructure will be key to growth - Sep 24, 2018

- Digitalisation will divide and drive economic progress - Jul 17, 2018

- More graphic analysis