China’s cyberactivity draws spotlight as 5G spreads

With its faster speed, lower latency and higher bandwidth, 5G holds the future of the Internet of Things

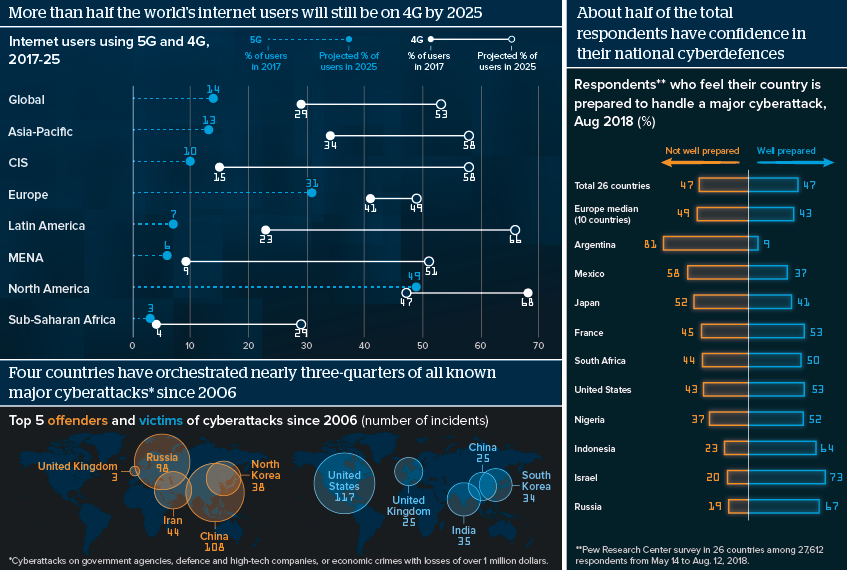

Source: GSMA; CSIS Technology Programme; Pew Research Centre

Outlook

Just as 5G enters widespread commercial use, Washington is pressing its allies to shun Chinese suppliers, especially Huawei. 5G combines hardware and software more than any of its predecessors: software is inherently vulnerable to cyberattacks, if easier to update and replace; hardware is harder to replace if compromised, although international standards are emerging.

Having Chinese private suppliers -- over whom Beijing exercises an unclear level of influence -- exposes China’s foreign partners to serious cybersecurity risks. Even so, cost advantages and broader acceptance of Chinese partnerships (and capital) will be decisive factors outside of the West, and even in Europe.

Impacts

- With Sub-Saharan Africa transitioning to 4G, China-friendly states will see longer-term advantages to keeping Chinese firms on side.

- Losing North American and European 5G markets would be a serious loss for Huawei in the near but not the longer term.

- Many countries in Asia, Latin America, Middle East and the Caucuses will embrace Chinese firms.

- Poor transatlantic relations will fuel European divisions on partnering with China on critical infrastructure.

- The May European Parliament elections will increase voices that favour an equidistant approach to Washington and Beijing.