High-debt, low-rates trend may trap poorer nations

The Fed and ECB have confirmed they will keep policy loose through 2019, but this may encourage more debt take-up

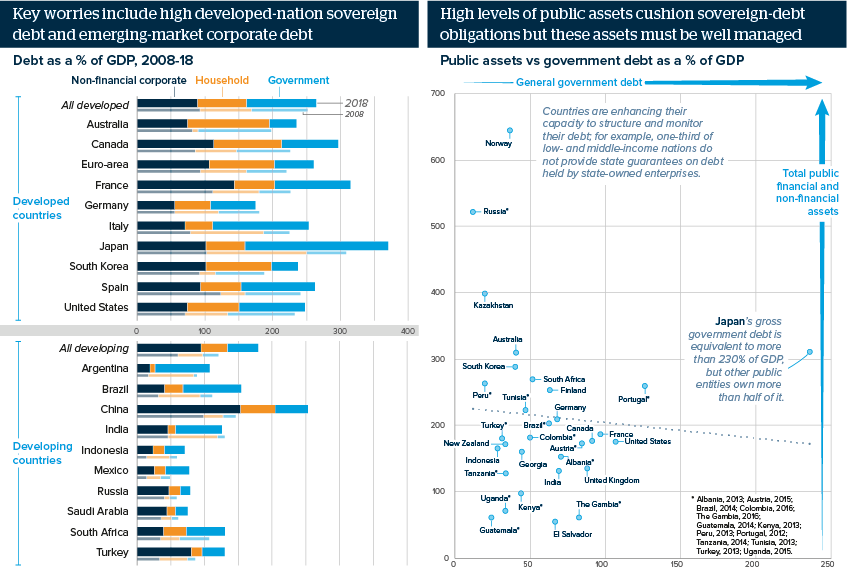

Source: Bank for International Settlements ; IMF

Outlook

The first inversion of long-short bond yields since 2007 is heightening concerns that the surge in debt taken on since the 2008 global financial crisis could trigger economic contraction. Recessions followed the previous seven yield inversions within 24 months.

Several factors mitigate spillover risk. Developed-nation sovereigns have the highest debt but the most trusting investors while the second largest holders, Chinese corporates, mostly hold their debt domestically. Moreover, corporate and household defaults are increasingly rare.

Quality is more critical than quantity. More than half the corporate-bond market comprises the lowest investment grade debt, up from one-third pre-2017. Institutional investors’ need to sell debt that is downgraded to junk status complicates refinancing and reduces prices.

Impacts

- In 2017, advanced nations’ public debt fell the most in years, as did private Chinese debt; both trends ease the global burden.

- A recession could cut US net worth (public assets minus pubic liabilities) by an estimated 26%, crimping policy scope.

- Debt creates a vicious circle: reducing growth but encouraging more to be taken on to sustain growth, trapping countries.

- Countries such as Germany have scope to run pro-growth budgets to avoid the risk of downbeat market expectations becoming self-fulfilling.

See also

- Investment-grade bond rating downgrade fears will rise - Oct 30, 2019

- Rising intra-firm corporate debt poses stability risks - Jul 4, 2019

- French and US corporate debt risks are rising - Jun 19, 2019

- US yield inversion signals recession within 1-2 years - Feb 8, 2019

- More graphic analysis