US-China tariffs will prompt supply chain switching

Industrial policy in both countries aims to stimulate indigenous manufacturing

Source: US Census Bureau, Bureau of Economic Analysis, IMF Direction of Trade Statistics, The US-China Investment Hub

Outlook

The rise in trade costs that will be a consequence of the Trump administration’s tariffs on its China trade and Beijing’s retaliatory actions will make ‘reshoring’ of manufacturing more attractive to multinational firms, but it will not substantially reduce firms’ costs or prices to consumers until technological advances give such moves more momentum.

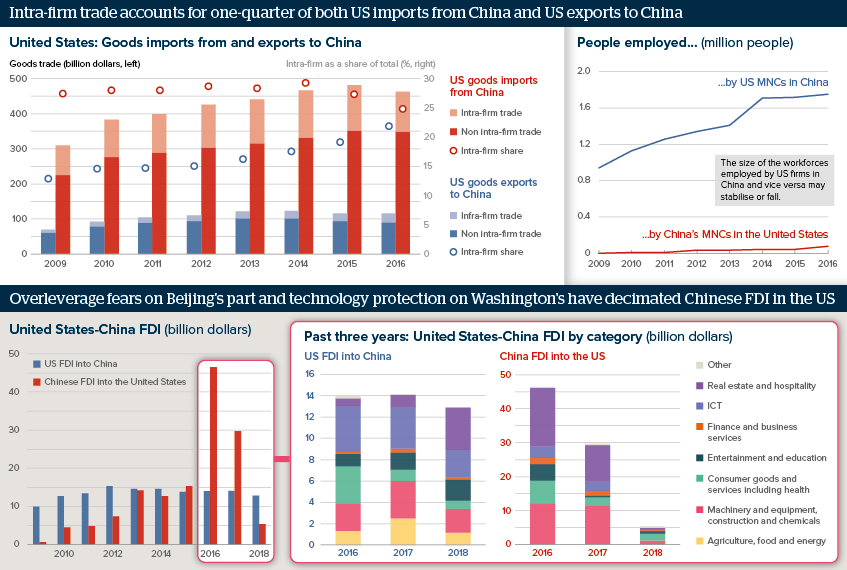

In the near-term, the relatively high proportion of intra-firm trade may provide scope for multinationals, particularly some US ones, to divert trade and switch up their supply chains to avoid the impact of tariffs.

Longer term, reconfiguring supply chains and reshoring may mitigate any permanent disruption to trade patterns caused by the US-China dispute, but also risks dampening longer-term growth if overall trade growth slows or shrinks. With Washington and Beijing both ready to extert political control over inbound direct investment from the other, the reduction in capital investment globally will also put growth at risk.

Impacts

- US multinationals’ larger revenues in China make them more vulnerable to trade disruption than their Chinese counterparts.

- Less retail, finance and professional services business in China would cut the US services surplus with China.

- Higher US FDI in real estate, tourism, education and entertainment in China in 2018 is vulnerable to political winds.

- Increasing the sophistication of China’s services sector is key to its long-term growth along with higher-value-added manufacturing.

See also

- US tech companies grapple with defence dilemmas - Aug 29, 2024

- Prospects for the global economy to end-2019 - Jun 28, 2019

- US-China tariffs worsen ASEAN middle-income trap fears - Feb 11, 2019

- More graphic analysis