Big tech’s share of some finance segments will surge

The network-to-activity loop lets ‘big tech’ firms gain market share quickly, but the loop may be vicious not virtuous

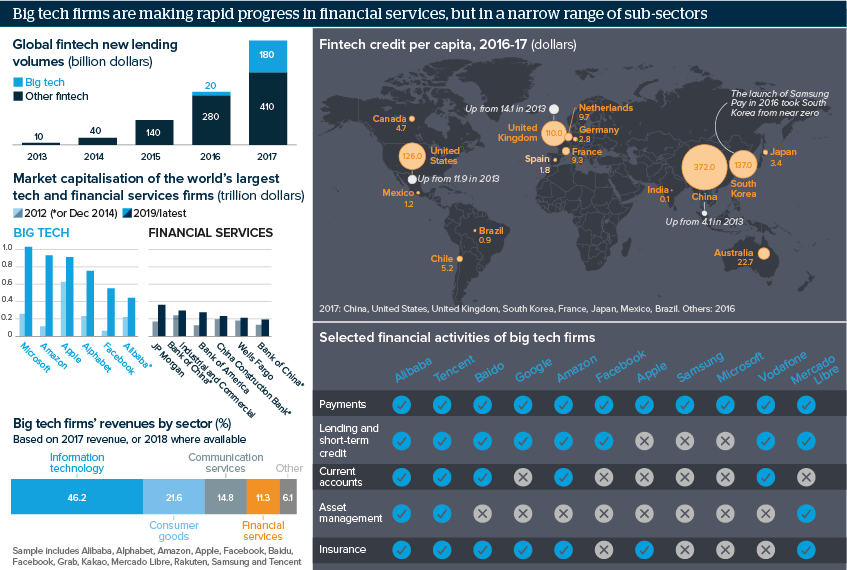

Source: Bank for International Settlements, Financial Stability Board, Thomson Reuters

Outlook

Big tech firms make more profit than traditional banks, giving them cash for innovation. Cash combined with a frontier IT system and access to loyal customers’ data gives big tech an advantage in payments and lending.

Big tech payment systems are bank-dependent as they overlay existing infrastructure or are proprietary systems but require users to have a bank account. Indeed, much of the progress has come from being a distribution channel for third-party providers of insurance or asset management.

In sectors including corporate finance where a longer history, personal interaction and expertise in risk and regulation are important, progress may come through collaborating with traditional firms.

Impacts

- Inclusion is key to all the 2030 Sustainable Development Goals; fintech can cut entry costs by providing an identity and payments network.

- Half of China’s previously surging money-market-funds invest short-term; rapid withdrawals would systemically threaten the banking sector.

- China’s regulation drive and slowdown enabled India to overtake it for fintech funding in January-March.

- The crime, custody, principal-agent and systemic risks are common to all finance, but some areas, notably data protection, need new rules.

- Each nation needs a competition body, a finance regulator and data protection rules; cooperation across these is key, and between nations.

See also

- Asset managers in the middle ground may be squeezed - Sep 26, 2019

- AI will transform finance but also exacerbate risks - Apr 9, 2018

- More graphic analysis