Public banks can finance SDGs more, but 2030 is a rush

The UNCTAD report urging public banks to do the “heavy lifting” to meet UN Sustainable Development Goals is ambitious

Source: Central Banks, Development Banks, Boston Consulting Group, SWF Institute, Thomson Reuters Datastream, Global Infrastructure Hub

Outlook

The UNCTAD Trade and Development report last month outlines ways that public banks can do more to finance the UN Sustainable Development Goals (SDGs).

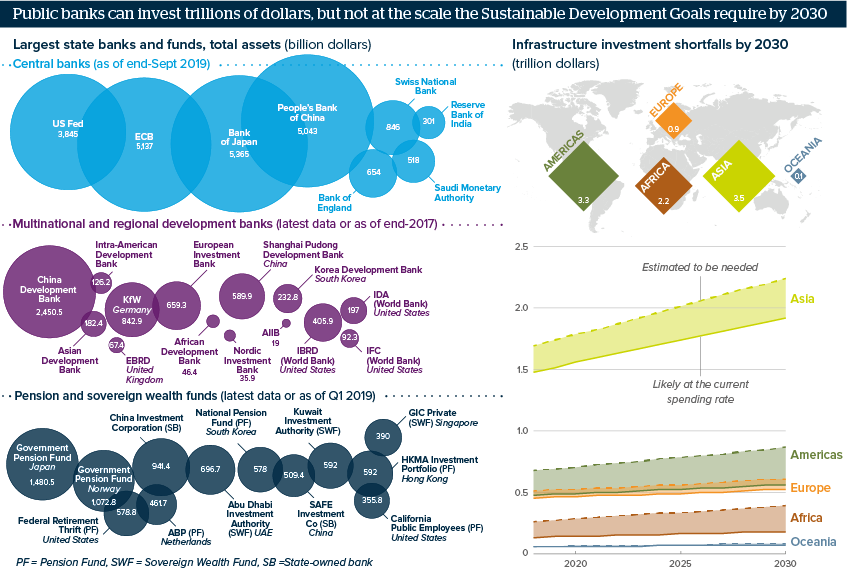

Initiatives struggle to meet private investment targets as although high yields are attractive, high geopolitical risks are not. Moreover, rules restrict institutional investors’ holdings. The Global Infrastructure Hub estimates that more than 48 trillion dollars is needed worldwide to meet the SDGs by 2030, but current investment rates suggest a shortfall of 10 trillion dollars.

Central banks are unlikely to fill the gap as they are busy balancing the need to encourage GDP growth with maintaining financial stability. The onus is on development banks and pension and sovereign wealth funds.

Impacts

- Weak global growth and trade may cut rather than lift the capital that public and development banks can lend, and nationalism is a threat.

- Lending from development banks in China and South Korea equals more than 10% of national GDP but other regions will struggle to match this.

- Private investors have trillions to spend and want to invest more with ‘impact’, but creating and regulating more channels may take years.

- Sovereign wealth funds face fewer restrictions than pension funds, and are in a good position to lead and support the SDG financing push.