Africa’s economic crisis will escalate debt crisis

Debt sustainability is a major concern as African economies reel from the worst economic crisis in decades

Source: IMF and World Bank

Outlook

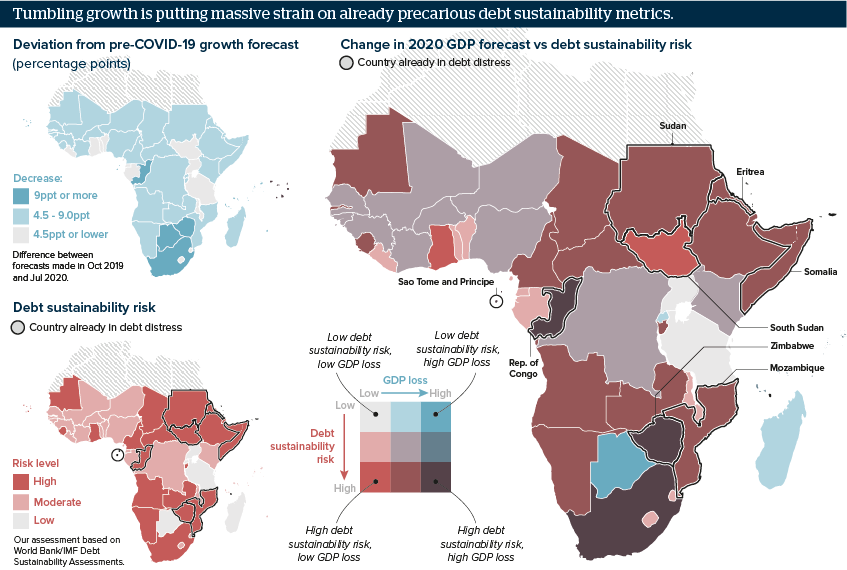

In the wake of the COVID-19 crisis, African economies face a major economic crisis, with GDP projected to contract possibly by a larger margin than at any time in the post-colonial era.

Severe downward pressures on revenues will constrict the fiscal space significantly, increasing debt service as a percentage of government spending even as pressures mount to find funds to stabilise the wider economy.

Debt-service relief and fiscal support from multilateral organisations and G20 donors will offer some breathing room, but the extent is limited and may not be sufficient to prevent a liquidity crisis from morphing into a debt crisis. Should this compromise access to financial markets, the post-COVID-19 economic crisis could prove much longer and deeper than current estimates.

Impacts

- Bilateral creditors will resist broader debt relief absent private sector involvement, to avoid taxpayer money lining private pockets.

- Debtors will be wary of risking creditworthiness by seeking private sector relief, as private finance may be needed to manage the crisis.

- Rising spreads on bond yields could make foreign-denominated debt prohibitively expensive, limiting capacity to refinance maturing debt.

- Limited access to foreign-denominated or concessional debt may encourage borrowing from China, but its lending capacity may be reduced.

See also

- Togo’s president will prioritise economic recovery - Jul 24, 2020

- Prospects for African economies to end-2020 - Jun 18, 2020

- More graphic analysis