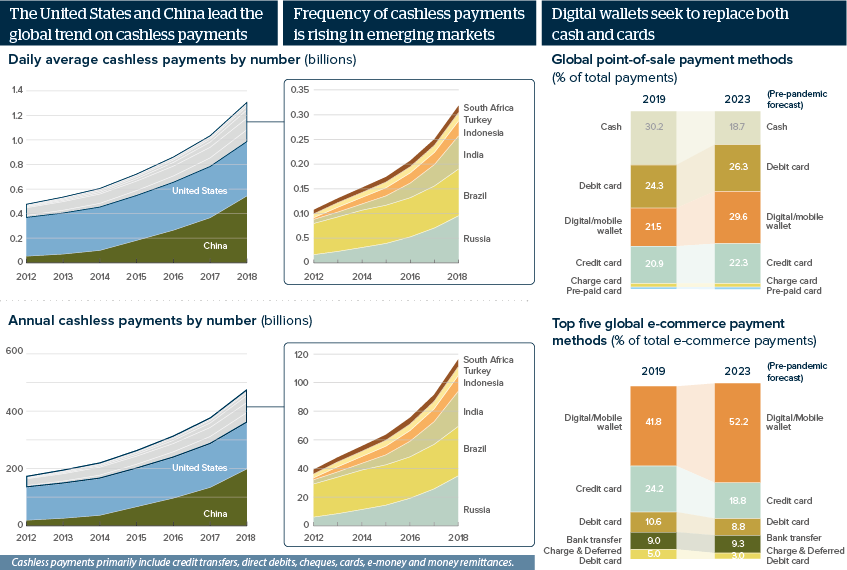

Pandemic will accelerate the rise of digital payments

Digitalisation of the global economy has increased the use of cashless payments worldwide

Source: Bank for International Settlements (BIS); Global Payments Report, WorldPay from FIS, January 2020

Outlook

The COVID-19 pandemic will accelerate the switch to digital payments worldwide. Since cash is dirty, expensive to print and circulate, and more easily evades financial transparency norms, a growing number of businesses and consumers will switch to digital payments, even for in-person purchases.

As consumer preferences change, both service providers and retailers are adopting an omnichannel business model offering a seamless offline and online experience. These models depend on a secure and simple digital payments infrastructure. Cross-border services and goods trade, facilitated by online platforms, will also increase the use of cashless financial tools.

Impacts

- As ever more businesses develop their digital presence, the cybersecurity needs of industry will multiply sharply.

- The popularity of digital wallets of companies such as Google, Apple and Facebook will intensify calls for tighter regulation of 'big tech'.

- Growing use of digital financial transfers should help reduce fraud, tax evasion and money laundering.

- Robust regulatory frameworks hold the key to wider adoption of cryptocurrencies and stablecoins.

- Mobile money will remain important in emerging markets, where formal banking and digital access is constrained.

See also

- Cashless payments will outgrow but not end cash use - Dec 12, 2022

- Volatility undercuts bitcoin’s effort to go mainstream - Jan 21, 2021

- Central bank digital currency launch is getting closer - Oct 14, 2020

- Regulation may lag stablecoin usage, delaying projects - Sep 16, 2020

- Digital currencies hold much promise for central banks - Apr 20, 2020

- Digitalisation will drive cross-border services trade - Oct 15, 2019

- More graphic analysis