‘Green’ tech will power industrial commodity prices

Demand will surge for the minerals for low-carbon technologies, but supply is concentrated and will lag, raising prices

Source: IEA Report on the role of critical materials in the energy transition, May 2021, Thomson Reuters Datastream, Oxford Analytica

Outlook

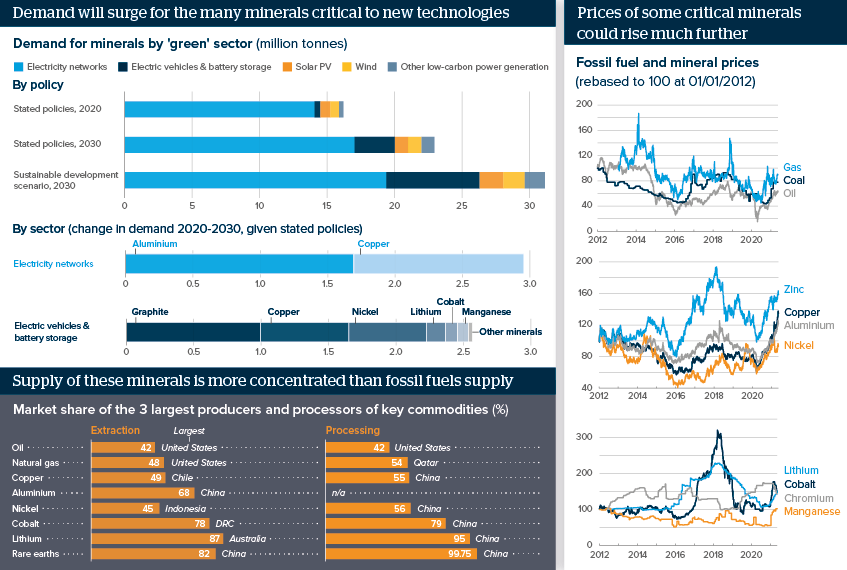

Commodity prices are surging, reflecting not only the recovery from 2020’s slump but also rising demand from construction, zero-carbon transport and renewable energy technologies.

Copper demand will surge, reflecting its importance to electricity networks, electric vehicles and wind and solar power. Investment in new supply will lag. Moreover, supply is concentrated, leaving it vulnerable to disruption. Aluminium could substitute for copper in some usage cases.

Similar medium-term supply strains apply to other minerals crucial to electric vehicles and batteries -- nickel, lithium, cobalt and rare earths. This demand/supply imbalance could see the prices of some industrial commodities rise above trend for a decade.

Impacts

- Wood Mackenzie sees USD1.7tn of mining investment as needed by 2035 to meet decarbonisation targets, far above spending of the last decade.

- Uncertainty over the metals mix that evolving EV and power storage technologies will need, and China’s GDP growth easing faster, pose risks.

- Output of many metals key to green tech is clustered in one or a few countries, potentially posing increased supply chain risks.

- Spare capacity, rising US output and OPEC+’s wish not to lose much market share will cap oil prices; gas prices also have limited upside.

See also

- Supply woes offset soft demand to lift copper prices - Jan 23

- Supply problems are multiplying in the copper market - Jan 26, 2023

- Rare-earth diversification may boost African producers - Jan 5, 2023

- Firms advancing rare earth plans will entice investors - Jul 26, 2022

- Rare-earth diversification will rise in Western states - Jul 11, 2022

- Climate change will drive dangerous inequality - Jun 24, 2022

- Russia conflict will fuel nickel market volatility - Mar 21, 2022

- Electric transport will transform the lithium sector - Feb 18, 2022

- China holds the advantages in EV battery manufacturing - Feb 14, 2022

- Copper volatility to persist amid market surplus - Jan 14, 2022

- Energy transition demand will elevate aluminium prices - Dec 24, 2021

- Graphite market imbalance will grow in the 2020s - Dec 22, 2021

- Automakers will rev up electric vehicle output - Oct 18, 2021

- Waning investment appeal will check the gold price - Aug 18, 2021

- Cobalt market tightness will persist this decade - Jul 22, 2021

- Prospects for the global economy to end-2021 - Jul 2, 2021

- Mining sector methods will evolve to meet climate aims - Jun 23, 2021

- Energy systems and economies will be mineral-intensive - Jun 15, 2021

- The Fed will be very cautious about policy tightening - Jun 15, 2021

- Seabed mining, and environmental fear of it, will rise - May 25, 2021

- International supply chains pose green challenges - May 21, 2021

- Low-carbon aims need a new set of energy technologies - Sep 3, 2020

- More graphic analysis