Pandemic deepens Latin America’s trade trends

The impact of COVID-19 on trade patterns deepened Latin America’s dependence on primary products

Source: ECLAC; IMF

Outlook

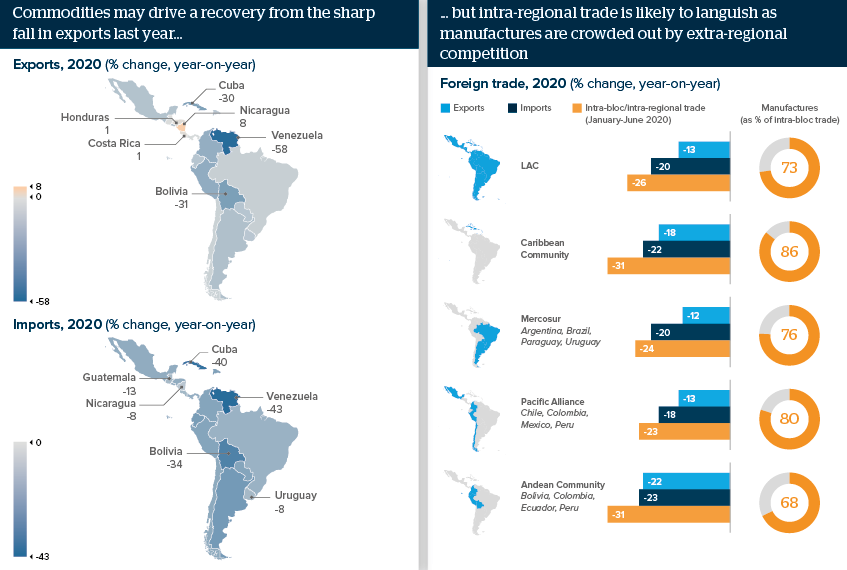

Latin America and the Caribbean saw an estimated 13% fall in exports in 2020, despite some recovery in the second half. Growth of 10-15% is expected this year, depending on the pandemic, but some shifts in trade will be long-term.

Much of the rise focuses on primary products, for which China is the main market. By contrast, intra-regional trade -- dominated by manufactures (for which China is the main competitor) -- shows few signs of recovery. Along with last year’s fall in imports, including capital goods, this suggests that the trend towards commodities and away from industrialisation will continue.

Impacts

- Higher global prices for food commodities are driving domestic food price inflation and hardship for consumers.

- With primary products now accounting for two-thirds of Brazilian exports, manufacturing competitiveness will decline.

- The focus on commodities will drive resource nationalism and calls for a rethink of mining concessions in particular.

- Lack of regional integration and infrastructure investment will further undermine competitiveness and post-pandemic recovery.

See also

- Resistance to Mercosur-EU trade deal will persist - Jun 15, 2021

- FDI flows will face mounting uncertainty in Brazil - Feb 17, 2021

- Trade will not drive Latin America recovery this year - Jan 27, 2021

- Chinese influence in Latin America will increase - Sep 29, 2020

- More graphic analysis