The emerging markets recovery will be fragile

Economic disruption has lasted longer for EMDCs than for advanced economies and China; this will hinder their prospects

Source: IMF World Economic Outlook, World Bank World Development Indicators, Bank for International Settlements

Outlook

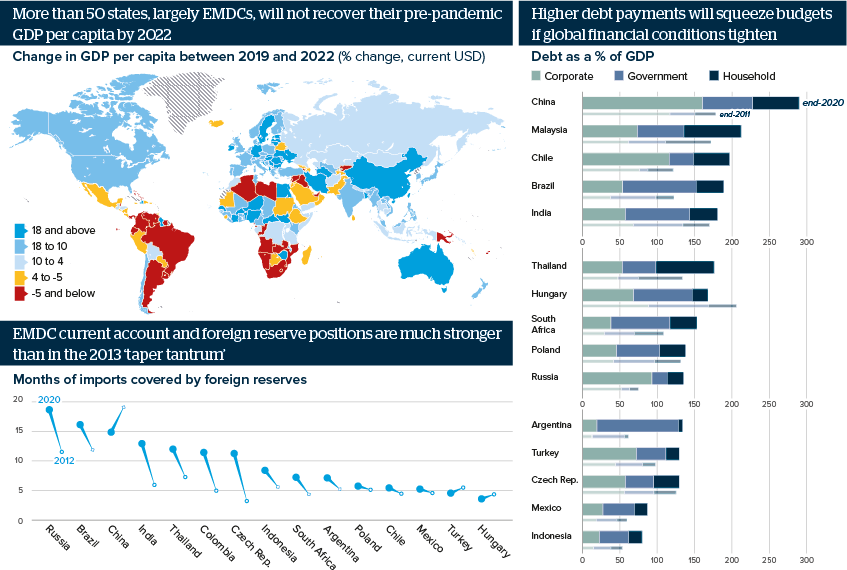

Many emerging market and developing countries (EMDCs) will struggle to achieve widespread vaccination by end-2022. Economies with weak healthcare, little scope to keep monetary and fiscal policy expansionary and limited diversification will face the risk of health crises leading to budget, political and social crises.

EMDC GDP growth outpaced that of advanced economies by three percentage points from 2010 to 2019. Consensus forecasts see this pattern resuming after 2022, with EMDCs growing by 4.5% annually in 2023-26. However, with Chinese growth expected to fall below 5% from mid-decade, this puts a heavy onus on improved performance from India, ASEAN, the Middle East and Latin America. It also assumes limited scarring from the pandemic and determined reforms thereafter.

Impacts

- The USD650bn SDR round will boost EMDCs' liquidity but does not target the neediest; global tax reform would not have an immediate impact.

- Middle-income nations cannot access G20-led debt relief, but many have as high a risk of health and budget crises as lower-income states.

- China’s growth will slow steadily from 10.3% relative to 2019 in the first quarter, but fears of a sharper, less orderly slowdown may rise.

- EMDC corporate debt rose from 102% of GDP at end-2019 to 119% by end-2020, led by China, Russia and Brazil; rate rises may hit investment.

See also

- Improved EM currency practices make Turkey an outlier - Jan 20, 2022

- Egypt weathers COVID-19 blow but debt risks loom large - Jul 30, 2021

- Build Back Better World scheme could challenge the BRI - Jul 16, 2021

- Prospects for the global economy to end-2021 - Jul 2, 2021

- More graphic analysis