The looming pensions crisis requires policy attention

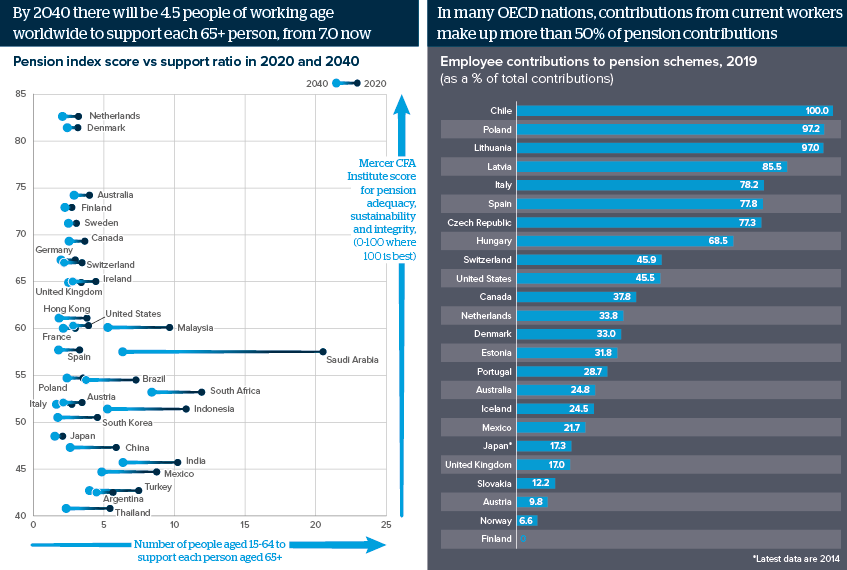

Straining pension systems, 25% of people in high-income nations will be aged 65 or more by 2040, twice the share in 2000

Source: UN World Population Prospects; Mercer CFA Institute Global Pension Index; OECD

Outlook

One-quarter of people in high-income states, and 20% of people in upper-middle income states including China and Brazil, will be over 65 by 2040. The retirement savings gap, the gap between private, employer and state pension pots, and the amount needed for over-65s to retire on 70% of their final income, will rise fivefold to USD400tn (108% of global GDP) by 2050, according to the World Economic Forum.

Some 75% of the 2015 savings gap was attributable to inadequate public investment. The damage done to public finances during the pandemic will reinforce government efforts to shift more of the burden to employees; defined contribution plans now account for over 50% of retirement assets.

Impacts

- COVID-19 has exacerbated pressures on pension systems from ageing and low growth by weakening health, job security and public budgets.

- The share of workers that are informal or self-employed is rising, putting pressure on governments to expand social security systems.

- Mercer’s latest survey shows that middle-income, non-Western states face the greatest pension-adequacy challenge.

- China’s state pension system could run out of money by 2035, and while the pension age may be raised from 60, more initiatives are needed.

See also

- EU likely to reform its Pan-European Pension Product - Jan 7

- Dependency ratios overstate economic impacts of ageing - Oct 9, 2023

- UK gilt crisis flags liquidity-driven investment risks - Dec 16, 2022

- US demographic change will have broad economic effects - Jan 5, 2022

- Demographic trends will shape economic prospects - Aug 5, 2021

- More graphic analysis