Digital currencies lag puts crypto investors at risk

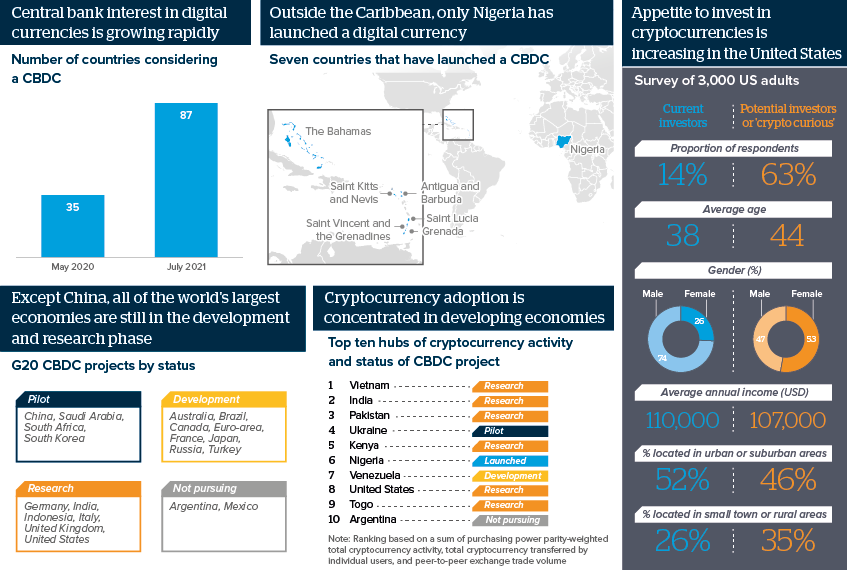

Some 87 countries, accounting for over 90% of global GDP, are exploring the potential of central bank digital currencies

Updated: Jan 25, 2022

Source: Atlantic Council CBDC Tracker, ChainAnalysis, CoinMarket Cap, Gemini 2021 State of Crypto Report and media reports

Outlook

Interest in central bank digital currencies (CBDCs) is intensifying, partly due to the cryptocurrency boom that risks eroding monetary policy effectiveness and systemic financial stability. Unlike highly volatile private cryptocurrencies, CBDCs would be regulated and reliable stores of value.

Yet beyond China -- which is piloting its digital yuan and has banned cryptocurrency investment, trading and mining -- policy action is slower than growing regulatory worries across other major G20 economies including the United States and India, which are top centres of cryptocurrency activity.

Slow progress on CBDCs and on cryptocurrency regulation could prove costly to crypto investors, who are predominantly young, male and urban, but are fast diversifying to include more women and rural/small city investors.

Impacts

- Chinese bans on cryptocurrencies will not eliminate such activity but will likely prevent it becoming a systemic risk.

- India is unlikely to ban cryptocurrencies given the scale of domestic activity; regulation is more likely.

- The glitches in the eNaira’s launch underline the difficulties of rolling out CBDCs, especially in emerging markets.

See also

- US push will accelerate digital currency plans - Mar 21, 2022

- Sanctions-busting role of cryptos is limited, for now - Mar 7, 2022

- India's crypto tax leaves key questions unanswered - Feb 2, 2022

- Thailand joins other markets on crypto curbs - Jan 25, 2022

- Remote working fuels crime in stolen data - Jan 24, 2022

- Spain contains cryptos as EU prepares tight regulation - Jan 18, 2022

- US financial services will help mainstream cryptos - Dec 21, 2021

- Investor interest in digital currencies is rising - Nov 24, 2021

- Cryptocurrency activity rises despite regulatory lag - Nov 12, 2021

- India’s cryptocurrency boom faces policy uncertainty - Sep 29, 2021

- Digital currencies mark a tectonic shift for banking - Aug 13, 2021

- China crackdown reshapes cryptocurrency landscape - Jul 22, 2021

- More graphic analysis