FDI into clean energy risks crowding out needy sectors

Global FDI rebounded to USD1.65tn in 2021, driven by strong flows to developing economies and especially to clean energy

Source: UNCTAD Global Investment Trends Monitor, January 2022, Financing Clean Energy Transitions in EMDEs, IEA report, June 2021

Outlook

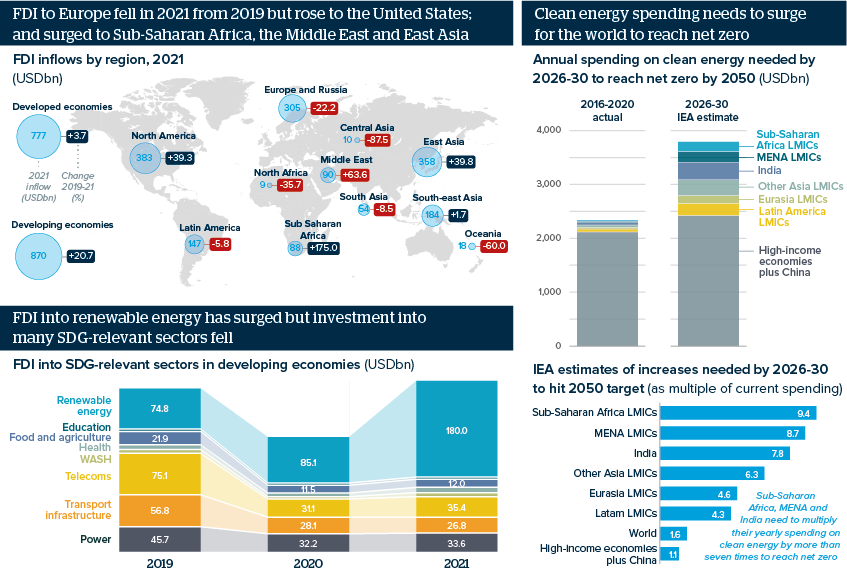

Foreign direct investment (FDI) to developed economies rose by 3.7% in 2021 compared to 2019 (to exclude the height of the pandemic). FDI to developing economies grew by 20.7%.

FDI into sectors relevant to the Sustainable Development Goals (SDGs) in developing economies rose by 5.1% in 2021 from 2019. While FDI into renewable energy in developing economies nearly tripled, investment into agriculture, telecoms, health and transport infrastructure fell.

Indeed, there is a risk that investments into cutting carbon emissions will crowd out investment in other sectors, holding back improvements to living standards and equality. Moreover, the scale of the clean energy investment needs suggests that the marginalisation of other investment needs could worsen.

Impacts

- FDI rose in 2021 to the highest since 2016, reversing the decade-long path of slower FDI; 2022-23 activity will be key to the 2020s trend.

- Far more global cooperation is needed to match developed world savings with developing nations’ urgent and rising needs.

- Merger and acquisition activity has firm momentum; it grew by 40% in 2021 from 2019, surging in ICT, logistics, finance and insurance.