Prospects for Turkey in the third quarter

The political situation points to an individual victory for HDP, but a stalemate between all parties

The third quarter will be a time of political uncertainty, if not instability. The first electoral defeat for the Justice and Development Party (AKP) has shifted the balance of power. AKP is 18 seats short of a majority and rifts between all four parliamentary parties make coalition-forming difficult. Three issues will probably dominate: the various configurations for a coalition or minority government; the Kurdish issue; and the prospect of early elections. Political uncertainty will add to obstacles slowing economic recovery, already hampered by global and regional economic conditions.

What next

For the first time 13 years, the direction of politics will be determined not by one, but by all four parliamentary parties' interaction. AKP will probably pursue a strategy of moderation in order to recover its losses in the next elections. The other three will try to capitalise on AKP's defeat but will be hampered by seemingly irreconcilable rifts over the Kurdish issue and memories of pre-2002 political and economic instability. The economy looks set to record another weak performance, with annual growth of about 3%, inflation topping 8% and unemployment at around 10%.

Strategic summary

- Non-AKP voters will consider the inconclusive elections an improvement over AKP's heavy-handed majority rule.

- CHP will play a pivotal role in the next three months, as it is the sole party that can lead a coalition or form a minority government without AKP.

- Growth will continue below par amid concerns about tighter global liquidity, reflecting Turkey's dependence on capital inflows to finance its large structural current account deficit.

Analysis

Political uncertainty will mark the next three months, but the public mood is optimistic and unalarmed by the instability risk.

Political aftermath

After the June 7 elections, there are four main possibilities:

- AKP remains in government, either in a minority or by 'importing' the 18 deputies it needs from other parties.

- A more likely outcome is AKP forming a coalition with one party.

- The Republican Peoples' Party (CHP) could form a minority government backed by the Nationalist Action Party (MHP) and Peoples' Democratic Party (HDP), or lead a three-way coalition.

- If parties fail to form a government within 45 days, early elections must be held.

The Kurdish issue will be crucial. HDP's electoral success has amplified it, but it remains divisive in broader society. President Recep Tayyip Erdogan will probably turn to a discourse of moderation, aiming to build political capital in the long term to boost AKP votes in the next elections.

Enter HDP

Two factors led to the dramatic change:

- AKP seems to have lost support among some of its core constituents, probably thanks to its recently tarnished reputation.

- HDP's gamble in standing as a party in the face of the 10% electoral threshold paid off.

HDP's success owes much to its ability to win voters among conservative Kurds, who tended to vote for AKP in the past, and to its appeal to left-leaning urban voters, who tended to vote for CHP or smaller leftist parties (see TURKEY: Weaker AKP would reduce Erdogan's authority - June 4, 2015).

A crucial element in HDP's position is its commitment to Kurdistan Workers' Party leader Abdullah Ocalan, whose name was invoked by key HDP leaders immediately after the victory. While HDP ruled out supporting or partnering with AKP before the elections, its commitment to Ocalan may eventually convince HDP leaders to negotiate with it.

More 'moderate' AKP

AKP suffered a setback, but it still took 41% of the votes and 47% of parliament's seats. It has signalled that it will 'soften' its rhetoric and accept some of its shortcomings in order to recover support. Erdogan will probably play the role of distanced and non-partisan moderator -- a sharp turn from his pre-election pose.

A lot depends on AKP's next move. Either a coalition or a minority government would constrain it. Alternatively, AKP could leave the burden of forming a government to the other parties. It could then blame them if this leads to political and economic instability and underline its point that only a strong majority AKP government can bring stability.

AKP remains by far the strongest political actor

There is no indication yet which path AKP will choose.

Strange bedfellows

CHP stagnated, securing 25% of the votes. Some of its core voters presumably responded to HDP's campaign call for CHP voters who wanted a counterbalance to AKP to vote for HDP to help it overcome the 10% barrier. CHP is keeping its options open, including coalition with AKP (which, in turn, AKP is not ruling out).

MHP is less compromising than CHP. Leader Devlet Bahceli has publicly ruled out a coalition with AKP or participating in any arrangement that involves HDP (including a minority government by CHP backed by MHP and HDP). MHP's position towards AKP may soften, but opposition to Ocalan is a 'red line' for most MHP voters and leaders.

MHP may prefer early elections

The economy

The formation of a viable government with a credible programme and ministers could revive investor confidence. The new government might increase pensions or wages, potentially boosting consumer spending (see TURKEY: Parties will raise voters' economic hopes - May 28, 2015). However, the third quarter will most probably be marked by a wait-and-see atmosphere.

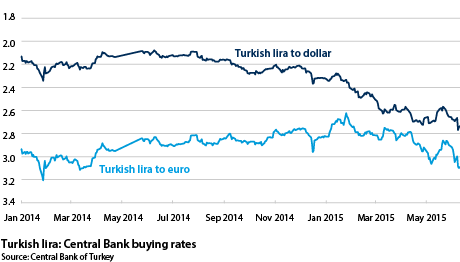

Exchange rate

The lira fell to 2.70/dollar after the election result. It will remain under pressure from both the political uncertainty and the possibility that the US Federal Reserve may start to raise interest rates in September (see INTERNATIONAL: Central banks will drive equity markets - June 5, 2015).

An indecisive election has put more pressure on the lira, already weakened by the prospect of global liquidity tightening

A significant rally is unlikely without clear signs of a government being formed; the possibility of fresh elections could push the lira/dollar rate to 2.80-2.90. The Central Bank will make use of daily liquidity tightening and other instruments to support the currency and curb volatility without selling large amounts of foreign exchange.

Monetary policy and inflation

Lira weakness will reinforce stubbornly high consumer price inflation, which was 8.09% at end-May. Even given cheaper mid-summer food, the headline figure will remain above the official year-end projection of 6.3% and the Central Bank's latest forecast of 6.8%, with fresh increases likely in the autumn.

In the absence of a government, the Central Bank is now under less pressure to cut its weekly repo lending and overnight lending rates of 7.5% and 10.75% respectively. The bank could consider modest increases on July 30, when it publishes its next quarterly inflation report.

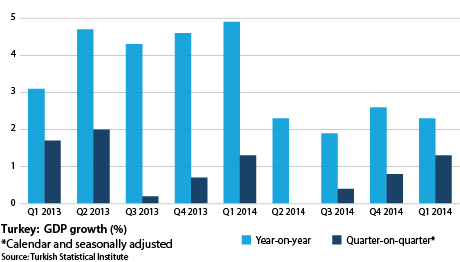

Economic activity

GDP grew by a below-trend 2.9% in 2014 and by 2.3% year-on-year in the first quarter of 2015. The second and third quarters will see a modest improvement at best. Interest rates are not high enough to choke off the faint ongoing recovery in consumer spending, but financial and confidence considerations will constrain investment.

A much better harvest is expected this year, but tourism will suffer from a drop in Russian visitors. Seasonally adjusted unemployment will continue to hover just above 10%.

External balances

Exports may continue to struggle against the background of a weak euro (Germany is Turkey's largest export market), recession in Russia and conflict in the Middle East. However, low domestic demand, reduced oil prices and a weak lira will keep the value of imports subdued.

Seasonal tourism revenues will swell the surplus on services, reducing the immediate need for capital inflows. The perennial current account deficit, which was 5.8% of GDP in 2014, is likely to narrow slightly this year but will continue to constrain the economy via the risk of exchange rate weakness.

_350.jpg)