Iran impact on global oil market will be slow

The Iran nuclear deal opens the door to higher global oil and gas supply

Brent crude oil closed at 53.3 dollars per barrel yesterday, a 21% drop from its recent peak on June 5 at 67.8 dollars. This drop reflected concerns over China's slowdown, fears that Greece would be forced to leave the euro-area, and the agreement of a deal between Iran and the P5+1 powers (five permanent UN Security Council members plus Germany) over Iran's nuclear programme on July 14. The

What next

Iran will announce its new petroleum contract model later this year. It is unlikely to include production-sharing contracts, but should be more attractive than in the past. Iranian crude exports should start rising from early 2016, although if compliance proceeds smoothly, some importers may act earlier in the belief that the will to enforce extra-territorial sanctions will dissipate. Iranian compliance may not proceed easily, as there is risk of pushback from opponents of the deal in both Iran and the United States.

Subsidiary Impacts

- Weaker oil demand from China and prospects of increased Iranian exports will keep crude prices low.

- Higher Iranian crude exports will keep oil markets in surplus for longer than expected if demand remains sluggish.

- The possible opening of Iran's oil reserves to foreign capital and expertise would add large and low-cost conventional oil production.

- Even with the agreement in place, Iran will remain a high-risk country in which to invest.

Analysis

For EU, US and UN sanctions to be lifted, Iran must comply with the terms of the agreement, and compliance must be verified by the International Atomic Energy Agency. This process should take six to eight months. Therefore, Iranian crude exports are unlikely to rise significantly until the first quarter of 2016 (see IRAN: Nuclear deal opens new era in ties with the West - July 15, 2015).

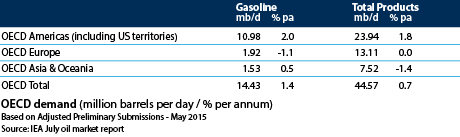

The lifting of sanctions should see the return of about 800,000 barrels per day (b/d) of additional Iranian crude to global markets. In its July oil market report, the International Energy Agency (IEA) forecasts global oil demand to grow by 1.4 million b/d in 2015, slowing to 1.2 million in 2016.

Non-OPEC supply is expected to remain flat next year, but with production rising in other OPEC countries, the lifting of sanctions is likely to keep crude markets in surplus, especially in 2016, when slowing demand will be met with the return of unfettered Iranian crude exports.

In the medium term, Iran is estimated to have 157.8 billion barrels of proved crude oil reserves, the fourth largest in the world, and 34 trillion cubic meters of proved natural gas reserves, the largest in the world.

Many major oil and gas companies held 'buyback' contracts with Iran, which set a fixed level for their scope of work, capital costs and rate of return on investment. These contracts lapsed when they failed to move projects forward after sanctions were imposed.

Some have already indicated their interest in returning to the country in a post-sanctions environment. Although the investment terms remain uncertain, Iran has signalled its intention to offer attractive terms and contracts (see IRAN: Foreign investors will return cautiously - July 20, 2015).

Easy oil, political risk

The global oil industry's move towards higher-cost sources, such as oil sands, heavy oil, deep water offshore, shale and Arctic was driven by high and sustained oil prices and a lack of access to remaining conventional reserves, particularly in the Middle East. This may now change.

18.1%

Joint Iran-Iraq share of global crude reservesTogether, Iran and Iraq account for 18.1% of total proved crude reserves. The lifting of sanctions holds out the prospect of larger conventional oil reserves, combined with attractive contractual terms, made accessible to foreign oil and gas companies.

With other Middle Eastern OPEC countries determined to boost output and compete against non-OPEC supply on price, rather than restrain output, the marginal cost of oil production is likely to shift downwards. This will intensify the search in higher-cost producing regions, such as the United States, for economies of scale and efficiencies in order to compete with low-cost Middle Eastern production.

Gas potential

700mn m3

Iran's estimated gas production capacityIran has huge proved natural gas reserves, including the giant South Pars gas field. However, domestically it remains unclear whether it has a significant gas surplus.

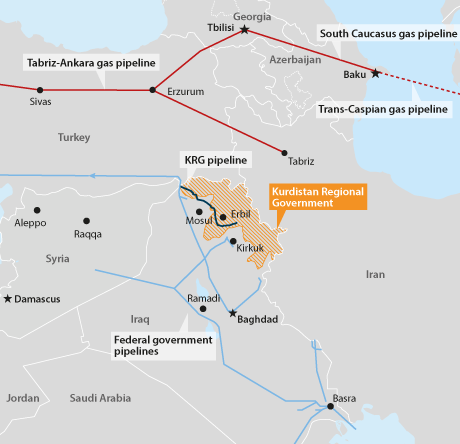

The country imports gas from Turkmenistan and exports to Turkey, though these volumes are small, accounting for about 4% of Iran's gas consumption and 5% of Iran's gas production. Imports from Turkmenistan are around 8 billion cubic meters yearly and go to an area of north-western Iran that is undersupplied from the Iranian gas network.

According to Iranian officials, the country's gas production capacity has reached over 700 million cubic meters a day, which, if true, implies a large shut-in surplus.

Turkey

Iran needs export links to affect external markets. Pipeline capacity could be expanded with Turkey, and Iran has reported that a major pipeline is being built on the Iranian side of the Iran-Turkey border. Construction time is around two to three years. Iran would then need access to pipeline capacity to take the gas westwards, either to Turkey's demand centres or further west to EU markets.

Little excess capacity exists in the Turkey gas transmission system. The 31 billion cubic meters per year Trans-Anatolian pipeline is under construction, but this will initially be filled with Azeri gas and will not reach full capacity until the early 2020s.

Furthermore Iran has a reputation as a high-priced and unreliable gas supplier, while existing suppliers, notably Russia, will remain well-placed to meet European demand requirements.

Pakistan

Iran could export gas to Pakistan. Iran says it has completed its side of the Iran-Pakistan pipeline, but no progress has been made within Pakistan because of a lack of financing and political pressure relating to sanctions.

Pakistan passed a tax in May to raise revenues for the improvement of the gas transmission infrastructure, including the Iran-Pakistan pipeline. The tax had been in force from 2011 until August 2014, when the country's supreme court ruled it unconstitutional, halting its collection. However, a number of projects will compete for these funds.

LNG projects

Iran has four liquefied natural gas (LNG) plants under construction, but this is unlikely to see much progress beyond site selection and ground clearance, as upstream development has been affected by sanctions.

Some oil majors, such as Total, have expressed an interest in developing LNG in Iran. This may prove a priority as LNG would allow access to multiple gas markets worldwide, avoiding the political and logistical complexities of the EU's Southern Gas Corridor, though the global LNG market is entering oversupply, so early moves may be difficult.

Iran could use existing liquefaction capacity in Oman and Abu Dhabi or supply growing Middle East markets in addition to Pakistan. It is also possible that international oil companies would commit to assisting with LNG developments as long as they include the opportunity to get involved in equity oil production.

_350.jpg)