China slowdown prompts 'supply-side' response

The slowdown of China's economy is forcing Beijing to seek a new kind of policy response

Updated: Feb 18, 2016

China's low inflation makes further stimulus likely · All Updates

The National Bureau of Statistics yesterday announced that GDP grew by 6.8% year-on-year during the last quarter of 2015, the slowest rate since 1990. China's economic slowdown has been gradual but, since the middle of last year, has been accompanied by a depressed property market and extreme volatility in capital markets.

What next

More turbulence is likely in the capital market this year due to both structural adjustment in the real economy and uncertainty over policy. More monetary easing is likely during the first quarter, and the renminbi will depreciate further. 'Supply-side' policies will become the government's focus in the year ahead, but are unlikely to boost growth much in the immediate term.

Subsidiary Impacts

- The renminbi will experience downward pressure due to the slowdown in China and rate hikes in the United States.

- Housing market inventory will decrease, putting downward pressure on property prices, especially in the second-tier cities.

- In equities, the 'slow bull market' sought by the authorities is less likely than a 'slow bear market'.

- Consumer price inflation is unlikely to pick up, leaving room for monetary easing.

- M&A activity among large SOEs is likely to increase in 2016.

Analysis

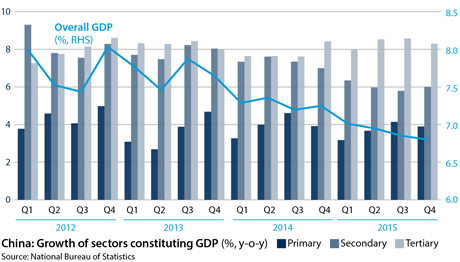

The GDP growth rate slowed to 6.8% year-on-year in the fourth quarter from 6.9% in the third, the National Bureau of Statistics reported on January 19.

This was the slowest pace of growth since the first quarter of 2009. Full-year 2015 growth at 6.9% was in line with the authorities' goal of growth 'around 7.0%'. In quarter-on-quarter terms, growth was 1.6% up in the fourth quarter, disappointing market expectations and down from 1.8% in the third quarter.

High-frequency activity data for December released today point to weaker growth momentum at the year-end -- as does a rise in labour unrest (see CHINA: Labour crackdown may backfire as economy slows - January 19, 2016).

Industrial production growth slowed to 5.9% year-on-year from 6.2% in November.

Year-to-date fixed-asset investment growth slowed to 10.0% from 10.2%, mainly thanks to sluggish housing investment. Infrastructure investment growth stayed upbeat at 17.0% in 2015, compared with growth of 19.9% in 2014, while manufacturing investment was weaker, at 8.1% in 2015 from 13.5% in 2014. The acceleration in infrastructure investment was not enough to offset the slowdown in property and manufacturing investment.

December retail sales were the bright spot, pointing to stronger private consumption. They slowed only marginally to 11.1% from 11.2% year-on-year.

Stock price volatility

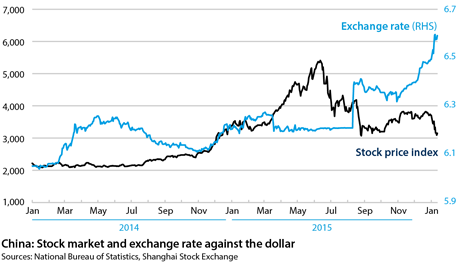

Since mid-2015, the stock market has been at its most volatile since 2007, and government interventions are widely held to have made matters worse (see CHINA: Stock market crash will blunt monetary policy - December 4, 2015).

Following a sell-off in December, the first half of this month has witnessed a further 21% drop in Shanghai Composite index, hitting a 13-month low (see INTERNATIONAL: China turmoil augurs badly for markets - January 13, 2016).

Retail investors have begun describing the Chinese stock market as neither bull nor bear, but a 'monkey' market. The volatility of the Shanghai Composite index (measured by standard deviation) is 2.42%, about twice as high as the Hang Seng (1.28%) and S&P500 (0.97%).

While government interventions have triggered these excessive fluctuations, investor expectation-driven and herding behaviour are the fundamental mechanism through which all these exogenous shocks have taken effect. They have been destabilised -- not stabilised -- by recent monetary policy and regulatory changes.

The renminbi has depreciated by some 4% since the end of 2015 following the US Federal Reserve's interest rate rise on December 16 and a phenomenal capital outflow. The funds outstanding for foreign exchange dropped by 629 billion renminbi (95.6 billion dollars) in December, the third-largest drop in history.

Together with deflationary pressures and worsening corporate cash flows, this will put the central bank under pressure to lower reserve requirement ratios and the interest rate by another 50 basis points in the first quarter of 2016, contributing to further depreciation of the renminbi of perhaps 5% during the quarter.

Housing market

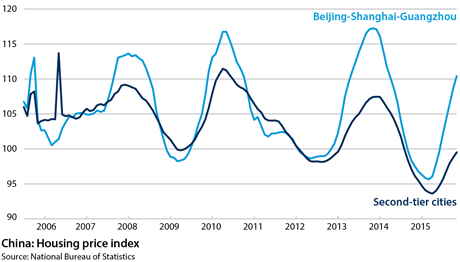

Housing investment growth fell sharply to 1.0% in full-year 2015 from 10.5% in 2014.

The slowdown in the real economy and the stock market weakness will be transmitted to the property market

With a lag of one or two quarters, the effects of the slowdown in the real economy and the sell-off in the stock markets will also be transmitted into the property market.

The sell-off in the stock market and the slowdown of the real economy will reduce firms' expected revenue and (overall) residents' income, translating into lower stock prices and weaker demand for property.

Meanwhile, the supply of property is inelastic because of accumulated inventory, so that a decrease in demand will lead to a more significant drop in property prices, especially in second-tier cities, where the majority of the housing stock has accumulated during the last decade and the divergence from the three major cities (Beijing, Shanghai and Guangzhou) is increasingly significant.

Supply and demand

On the demand side of GDP, consumption and investment continued in the fourth quarter of 2015 to grow at double-digit rates (by 10.7% and 10.8% respectively, year-on-year), but export growth has slowed to 2.3% and overall trade dropped by 0.5% year-on-year in the fourth quarter of 2015, indicating weak external demand.

On the supply side, the industrial structure has shifted further towards the services sector, which continues to expand faster than the rest of the economy, at 8.3% year-on-year compared with 6.1% for the secondary sector. This aspect of the sought-after economic 'rebalancing' is effectively under way.

Meanwhile, the growth rate for value-added at state-owned enterprises (SOEs) has slowed to 2.6% compared to 7.1% among non-SOE exchange-listed companies.

Rebalancing towards services and consumption is under way

Demand drivers

External demand for Chinese products has experienced volatility and has fallen overall during 2015 (by 1.8%). Internal demand is stable, but the role of investment has weakened, and consumption has assumed a greater role in GDP growth.

The industrial structure is already changing in accordance with the government's idea of 'supply-side reform', which focuses on the efficiency of production processes and resource allocation, reflected in industrial structure transformation: the tertiary sector (mainly services) grew by 8.2% in the fourth quarter, compared to 4.1% and 6.1% growth rates in agriculture and manufacturing respectively.

The slowing of the secondary sector is mainly due to:

- excess capacity and inventories in SOEs as a result of production and investment being directed by policy rather than the market; and

- supply-side reforms.

The latter have seen excess production capacity removed or privatised (eg, industrial reform in the north-east provinces), and competitive SOEs consolidated via the capital market to form gigantic SOEs to compete in the international market. There has been a new wave of consolidation of SOEs in the capital market through mergers and acquisitions (M&A) during 2015 and this trend will be stronger in 2016.

Consumer price inflation has been low since the first quarter of 2015, but this does not yet indicate a danger of a Japan-style 'deflationary trap', at least in the short run. China's current low inflation is due foremost to low energy prices, rather than fundamental longer-term changes such as demographic pressures -- a problem China will eventually face, but probably not before 2020 or later.

Supply-side policies

Officials, businesses and scholars in China refer to the three components of GDP -- consumption, investment and net exports -- as the three drivers of economic growth.

The three are derived from the GDP accounting identity in the expenditure approach, but this identity does not imply causality. The two internal demand components (consumption and investment) not only determine GDP but also depend on GDP, so that a fall in investment causes GDP and national income to fall, which in turns reduces the propensity to consume and invest.

One way to break the vicious cycle is to stimulate and restructure production, which translates into higher income, consumption and investment. This is the theoretical foundation for the 'supply side' reform, emphasised twice by President Xi Jinping in addresses in the closing months of 2015, which signalled the focus of government policies in 2016.

Arguably, there are also three drivers on the supply side: capital, labour and technology. Supply-side reform aims to promote efficient use of capital and labour in production.

To achieve this, four future directions have been highlighted by the government following Xi's speeches:

- to resolve excess capacity on the supply side;

- to clear inventory in the housing market;

- to lower costs in production; and

- to develop a multi-level capital market.

The former two focus on outputs, the latter two on inputs.

The key to supply-side reform is to promote technological progress and productivity. To achieve this, R&D and innovation need to be protected by intellectual property legislation and institutions. One indicator of progress here is that the State Intellectual Property Office received over 1 million patent applications in 2015, 18.7% higher than 2014 (thanks partly to the setting up of six new regional centres around the country to facilitate patent application and approval, in addition to the centre in Beijing).

Future policies will be more oriented towards technology, such as tax benefits for innovative enterprises

Quality versus quantity

Government policies will focus on encouraging high-quality products and innovative firms

Retail sales are still growing in double digits (by 11.1% year-on-year last month), but the quantity of Chinese products continues to rise much faster than their quality. A telling sign here is the preference of many Chinese consumers for expensive imported products over cheaper domestic substitutes, in areas as diverse as milk powder to motor vehicles -- one reason why shopping is such a high priority for many Chinese tourists.

Supply-side reform is impossible without innovation; the central government in December 2015 issued a series of policies to institutionalise protection of intellectual property in order to protect domestic innovation. One such piece of legislation is the draft Patents Law published on December 2.

Policies will attempt to channel economic resources towards the most competitive producers. There will probably be changes to taxes and subsidies, but the development of a multi-level capital market for innovative SMEs is another new feature.

Another is the creation of large SOEs to compete in global markets such as the United Kingdom (see CHINA/UK: Trade will boom, but US ties come first - October 21, 2015) and support the 'One Belt, One Road' and Asian Infrastructure Investment Bank (AIIB) foreign policies (see CHINA: AIIB will reshape development finance landscape - March 30, 2015).

_350.jpg)