China turmoil augurs badly for global markets

The China-led sell-off has got 2016 off to a bad start for financial markets

Updated: Feb 9, 2016

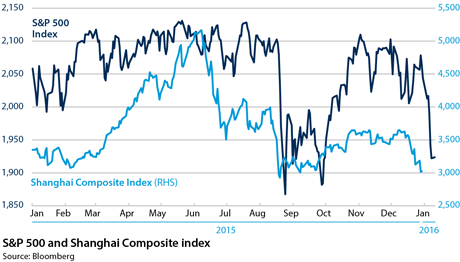

The renewed turmoil in China's financial markets in the first trading days of 2016 has undermined investor sentiment, wiping 2.3 trillion dollars off the value of global stock markets and leading to a surge in demand for safe-haven assets. While the Shanghai Composite index rebounded on January 8, it dropped again on January 11 by 5.3%, dragging down the US S&P 500 equity index, which dropped 6% in the first trading week of 2016, its worst start to the year on record and a sign of the extent to which China has become the most important sentiment determinant.

What next

Market conditions will remain volatile, with scope for further equity sell-offs given the erratic measures undertaken by Beijing to try to shore up China's equity and currency markets. The further 15.5% slide in oil prices since the start of 2016 will put commodity currencies under more strain, boding ill for Latin American assets in particular. A China-driven sentiment deterioration could also cause the US Federal Reserve (Fed) to reassess the pace and scope of its rate-hiking cycle, potentially weakening the dollar.

Subsidiary Impacts

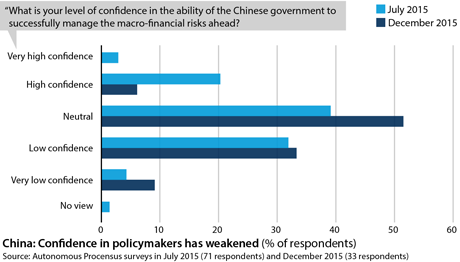

- The credibility of Chinese policymaking is undermined, heightening concerns about the country's slowdown and auguring badly for many EMs.

- Central banks will be another source of volatility, especially if investors lose confidence in the effectiveness of monetary policy.

- A weaker-than-expected dollar will pressure the ECB further to provide more monetary stimulus.

Analysis

On January 4, the Shanghai Composite index plunged by 6.9%, after triggering a new 'circuit-breaker' rule that resulted in trading being suspended nationwide for the first time. This caused the US S&P 500 equity index and the Euro Stoxx 50 to fall by 1.5% and 3.1%, respectively, on the same day, with Germany's China-sensitive bourse declining 4.3%.

The sell-off was triggered by concerns about the contraction in Chinese manufacturing activity last month, as the Caixin December manufacturing purchasing managers' index (PMI) fell to 48.2 from 48.6. On January 1, the official December manufacturing PMI was at 49.7 from 49.6.

Within the official manufacturing index, most sub-indexes remained below the 50 threshold between expansion and contraction. The employment sub-index fell to 47.4, a 47-month low.

The sell-off was exacerbated by the renminbi's weakness, in particular the divergence between the tightly managed onshore and the market-driven offshore exchange rates against the dollar, suggesting investors are pricing in further depreciation. On January 12, the People's Bank of China (PBoC) kept its renminbi fixing unchanged, while accelerating its buying of offshore renminbi, which achieved parity with the onshore currency for the first time since October.

The PBoC is trying to curb bets on further renminbi weakness and to reduce the gap between onshore and offshore exchange rates, as required by the IMF in order to keep the renminbi in its special drawing rights basket.

$2.3tn

Value wiped off global equity markets between January 4 and 8

Global equity markets suffered further declines in the following days, as yet more erratic and confusing policy measures by Beijing to stabilise the country's stock and currency markets prompted further selling. Between January 4 and 8, a staggering 2.3 trillion dollars was wiped off the value of global equity markets, the worst start to the year on record.

Oil prices declined to a low of 30.9 dollars per barrel on January 12, while emerging market asset prices came under further strain, with the South African rand and the Russian ruble falling by 4.5% and 2.6% respectively against the dollar in the first trading week of 2016.

While developments in China (and their impact on the commodity complex) have been supplanting the conduct of US monetary policy as the main determinant of sentiment for some time, the latest financial turmoil shows the extent to which the 'China factor' has an overriding influence on price movements (see US/INT: Fed will struggle to hike rates much in 2016 - January 6, 2016).

Emerging and commodity markets

Although local retail investors account for as much as 90% of trading in China's equity markets, Chinese policymakers have underestimated the strength of the feedback loop between the country's plunging stock market and speculative pressure on the renminbi, now the focal point of market nervousness about China among traders and institutional investors.

China's foreign exchange reserves fell by 108 billion dollars last month, the largest single monthly decline on record, as the PBoC stepped in to defend the currency. However, the central bank's greater tolerance of a weaker renminbi and its new focus on the currency's value against a basket of currencies (as opposed to the exchange rate against the dollar, which investors follow more closely) is sending mixed signals and adding to fears of 'currency wars', particularly in the emerging Asia region.

The rise in the dollar in the run-up to, and following, the Fed's decision to hike interest rates on December 16 is putting further downward pressure on the renminbi, contributing to capital outflows and causing the Bloomberg JP Morgan Asia Dollar Index, a gauge of the performance of Asian currencies except the yen, to fall by a further 1.1% year-to-date. JP Morgan notes that "the outlook for emerging Asian currencies in 2016 almost starts and finishes with the outlook" for the renminbi.

Emerging market (EM) funds suffered their worst year on record last year, with equity funds suffering outflows of 65 billion dollars and bond funds suffering redemptions of 12 billion dollars, the first year of net outflows since the financial crisis.

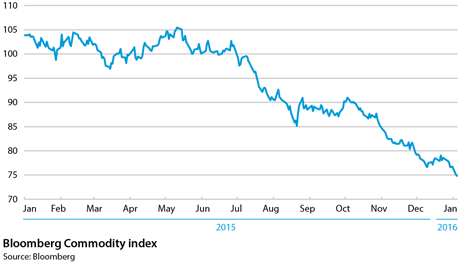

China's financial turmoil is also putting commodity markets under further strain, with the Bloomberg Commodity index dropping by 2.3% last week, having already fallen by a dramatic 23.5% in the second half of 2015.

The broader concern among investors is that turbulence in China's financial markets is undermining the cause of financial sector reform and encouraging Beijing to clamp down on market forces, notably speculation against the currency.

Fed rate hikes question

The extent to which investor sentiment is being shaped by developments in China was thrown into sharp relief by the publication on January 8 of a strong US employment report for December, which showed robust wage growth, at 2.5% year-on-year. While this ought to have buoyed US equities and pushed up Treasury yields, the reverse happened, with US stocks falling and the yield on ten-year Treasuries dropping by a further three basis points (bp) to 2.12%.

20%

Current chance of the Fed hiking rates three times this year, as priced in by Fed Funds futures

The Fed Funds futures market is now pricing in only a 20% chance of the Fed hiking rates three more times this year, compared with 40% before the China-led sell-off and the Fed's own expectations that it will hike rates four times this year, each hike being worth 25 bp.

A sustained China-driven sentiment deterioration, particularly one which causes more turmoil in the commodity-sensitive US corporate debt market following the closure last month of a number of high-yield bond funds, could delay the Fed's tightening cycle (see INTERNATIONAL: EM corporate debt is key vulnerability - October 13, 2015). It could also increase the scope for a disorderly correction if the Fed hikes rates quickly, given bond investors' increased scepticism about the pace of the tightening cycle.

_350.jpg)