Brexit vote will keep global markets volatile

Markets experienced a broad-based sell-off in the aftermath of the UK referendum on EU membership

UK equities and the pound continued to fall in European trade this morning while 'safe-haven' assets such as gold and the yen surged. The UK vote on June 23 to leave the EU ('Brexit') startled global financial players, putting pressure on leading central banks to stabilise markets and keep bank funding flowing. The Bank of England (BoE) announced that it was ready to provide an extra 250 billion pounds (341 billion dollars) to ease liquidity conditions while the ECB is also ready to deploy significant funds to avert a liquidity squeeze.

What next

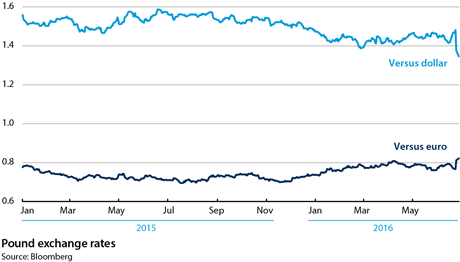

While the pound will bear the brunt of the sell-off, declines in European banking stocks and 'political contagion' across the bloc could lead to renewed financial tensions. The uncertainty about Brexit's political and economic consequences, exacerbated by the immediate UK political vacuum, could cause the pound to weaken a further 10-15% against the dollar. A Brexit-induced rally in the dollar will make it very unlikely that US interest rates will rise this year, and put renewed pressure on commodity prices and emerging market (EM) currencies.

Subsidiary Impacts

- Market conditions will remain volatile, but there is little sign that markets are treating the vote as a systemic crisis.

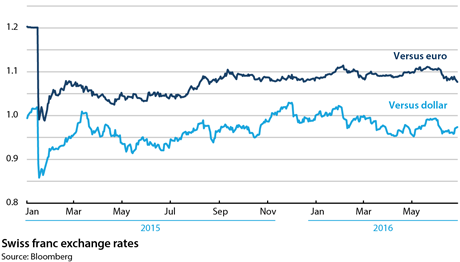

- Investor demand for safe-haven assets will spike; assets such as gold, the Swiss franc and the Japanese yen will appreciate.

- The ECB's QE programme could help insulate euro-area peripheral government bonds from the spillover effects of Brexit.

- Having been surprised by the UK referendum, markets will become more sensitive to political risk ahead of the US election.

Analysis

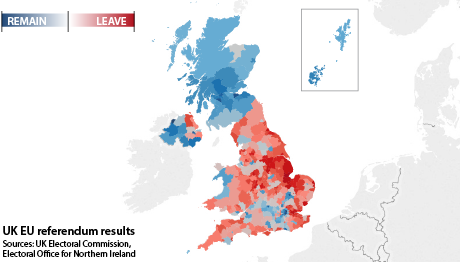

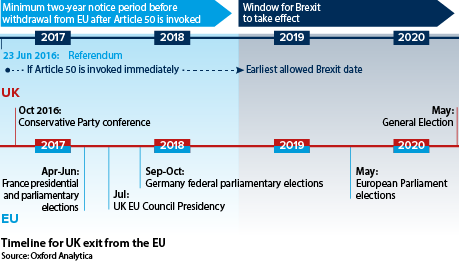

In a high-stakes referendum on EU membership on June 23, UK citizens voted by 52% to 48% for their country to withdraw from the bloc, plunging UK and European politics into a period of instability and sending shock waves through global markets (see UNITED KINGDOM: 'Brexit' vote will weaken EU - June 24, 2016).

On June 24, the pound fell to its lowest level against the dollar since 1985, losing 9.3%, while the yield on benchmark ten-year Gilts (UK government bonds) fell to a record low of 1.08%. The FTSE 100 equity index dropped by 3.2%, having initially fallen by nearly 9.0% as bank shares plummeted.

Those losses were extended this morning, even after the chancellor of the Exchequer, George Osborne, sought to reassure investors that contingency plans were in place to shore up the UK economy. Notably, the ten-year Gilt yielded below 1% for the first time.

-0.17%

New record low for ten-year Bund yieldsThe 'Leave' victory triggered a 'flight-to-quality' in global markets, causing the Japanese yen to strengthen by a further 3.4% against the dollar to 102.93, and pushing down yields on benchmark ten-year German and US government bonds to minus 0.17% (a new record low) and 1.57%, respectively.

Sentiment in equity markets deteriorated dramatically, with more than 2 trillion dollars wiped off the value of global shares, including a staggering 830-billion-dollar loss on the valuation of US equities.

EM assets came under renewed strain because of the resurgence of the dollar and pressure on commodity prices (see PROSPECTS H2 2016: Emerging economies - June 15, 2016).

The fixed income market is likely to be the least volatile part of markets over the next few weeks, because of central bank action. Peripheral euro-area spreads could widen, but the ECB will use all available tools to contain credit fragmentation, including the Outright Monetary Transactions programme.

On June 21, the German Constitutional Court ruled in favour of the ECB bond-purchasing programme, unveiled in 2012 at the height of the sovereign debt crisis. Despite never being implemented, it is credited with the cyclical improvement experienced since then.

The court said the programme would not impair the German parliament's budget responsibility or exceed the ECB mandate.

Brexit and central banks

Moody's, the rating agency, lowered the outlook on the United Kingdom's credit rating to 'negative' from 'stable' on June 24, citing a "prolonged period of uncertainty" and hinting at a cut in the country's rating.

Standard & Poor's, another rating agency, also warned that the vote to leave the EU was likely to trigger a rating cut.

The scale and severity of the deterioration in sentiment following the Leave vote is putting pressure on leading central banks to stabilise markets and forestall a collapse in confidence reminiscent of the one following the bankruptcy of Lehman Brothers in September 2008, which triggered the global financial crisis (see US/INTERNATIONAL: More financial turmoil yet to come - September 15, 2008).

On June 24, the BoE pledged to provide an additional 250 billion pounds to shore up the UK financial sector and said further policy measures might be required to deal with "a period of uncertainty and adjustment".

Futures markets are assigning a 50% probability to an interest rate cut by next month's BoE policy meeting, according to Bloomberg.

5.2%

UK current account-to-GDP ratio in 2015

The BoE has also warned of the dangers stemming from the United Kingdom's record current account deficit, which amounted to 5.2% of GDP in 2015. This could reduce the scope for rate cuts, depending on how sentiment towards UK assets fares in the coming days.

The ECB, the US Federal Reserve (Fed) and the Bank of Japan (BoJ) have all pledged to provide further liquidity if needed.

On June 24, the Swiss National Bank intervened to contain upward pressure on the Swiss franc, which has appreciated the most since January 15, 2015, when the central bank removed its cap to the euro.

Still, the UK decision to leave the EU comes at a time when confidence in the effectiveness of monetary policy has waned and central banks themselves have become sources of volatility (see PROSPECTS H2 2016: Global economy - June 1, 2016).

The ability of central banks to counter a sharp and sustained deterioration in market conditions is now even more questionable than it was in the aftermath of the 2008 financial crisis.

Dollar boosted by flight-to-quality

The flight-to-quality move triggered by the referendum outcome has lifted the dollar index, a gauge of the greenback's purchasing power against a basket of currencies, owing mainly to the weakness of the euro, which has a nearly 60% weighting in the index.

On June 24, the euro fell by 1.0% against the dollar, helping lift the dollar index by 2.1% to 95.4.

While the combination of a stronger dollar and financial turmoil stemming from the UK referendum makes it very unlikely that the Fed will raise interest rates this year, EM assets could come under further strain if the dollar strengthens further and sentiment deteriorates more sharply.

On June 24, the Mexican peso fell by 3.8% against the dollar, while the South African rand lost 4.1%.

The peso is the worst-performing major EM currency this year, partly because of concerns that Donald Trump, the US Republican presidential candidate who has pledged to build a wall along the US southern border with Mexico, may win November's election.

The resumption of a Brexit-induced bull market for the dollar would have significant implications for foreign exchange markets, putting renewed pressure on EM currencies, but doing little to reduce upward pressure on the yen, increasing the scope for intervention by Japanese policymakers.