Industry 4.0 will arrive unevenly

Manufacturing is in the early throes of the next industrial revolution

Updated: Oct 17, 2016

Dubbed variously 'Industry 4.0', 'intelligent manufacturing' or the 'internet of everything', cyber-physical systems that control the flow of materials, products and information are starting to transform industrial production and supply chains. They will eventually disrupt business models and challenge policymakers.

What next

Developed economies will promote Industry 4.0 as a pathway to enhanced global competitiveness, a resurgence of manufacturing and disruptive product innovation in the hope that it will create and retain well-paying domestic jobs. Falling costs as the underlying technologies scale will make this feasible. However, substantial technology, business model and regulatory challenges would need to be overcome. Cybersecurity risks will increase exponentially. Net new job creation may take far longer than a likely lengthy initial period of job destruction, fueling social restiveness.

Subsidiary Impacts

- Improved production flexibility and vertical integration with customers should facilitate bespoke manufacturing ('mass customisation').

- Entire value chains will vertically integrate, embracing product design, procurement, production, distribution, sales and maintenance.

- Horizontal integration around smart factories will create new business models based on manufacturing as a service (MaaS).

- Pay-by-use and subscription-based MaaS could upend traditional models for financing capital expenditure on plant and equipment.

Analysis

The term Industry 4.0 derives from the German-government-sponsored Industrie 4.0 Working Group set up in 2011 to study the advanced computerisation of manufacturing and subsequently backed with 200 million euros (221 million dollars) of government research and development (R&D) funding.

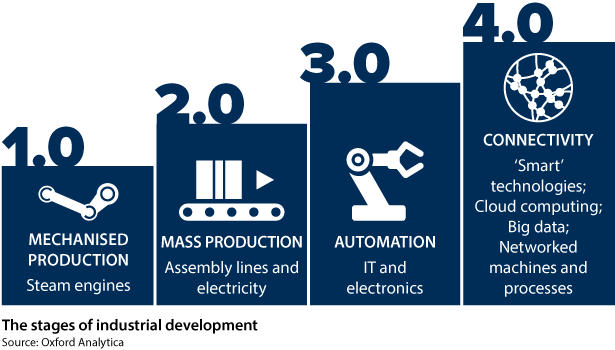

The reference to a prospective fourth industrial revolution was a deliberate move to connect Industry 4.0 to the three revolutions that went before: manufacturing driven by steam power, assembly line production driven by electricity and automation driven by electronics/IT.

€200mn

German government funding for an Industry 4.0 working group

In the United States, Industry 4.0 is called the internet of everything as it brings together the internets of things, services, data and people.

Sensors, radio chips, software and embedded intelligence are integrated into networked industrial products and systems to manage and optimise product sourcing, production, performance and service needs.

Making machines self-aware, self-organising and continually self-optimising, and networking them together along the value chain should create industrial systems that perform more efficiently, collaboratively and resiliently than conventional manufacturing.

The underlying technologies involved also include big data and analytics, predictive analytics, artificial intelligence, robotics, additive manufacturing ('3D printing'), everything-as-a-service and cloud computing, and business-to-business online marketplaces.

Technology convergence

Four factors have reached a scale and convergence that is starting to turn the highly automated plants of multinational consumer and industrial goods companies into pioneering Industry 4.0 platforms. They are:

- advances in computational power and connectivity that allow the processing of large data volumes and their visualisation;

- the application of analytics and artificial intelligence to business logic and processes;

- the manifestation of digital programmes in the physical world through, for example, 3D printing; and

- the development of interfaces for human-machine interactions such as touch screens and virtual reality.

In future, these industrial platforms will be able to link to other 'smart' networks, for example, autonomous logistics and transport networks, smart grids for power and energy-optimised smart buildings and other infrastructure.

Government support

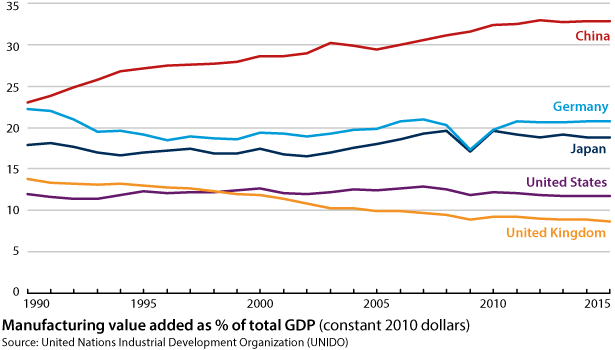

Developed economies, notably Germany and the United States, are funding Industry 4.0 R&D and infrastructure. They mostly incorporate it into industrial policy via promoting public-private partnerships for innovation centres connecting business and researchers, centres of manufacturing excellence and apprenticeships to fill skills gaps.

In Germany, Industrie 4.0 is the centrepiece of the government's High-Tech Strategy 2020 Action Plan. The US administration launched the public-private Advanced Manufacturing Partnership in 2011 and updated it in 2013.

Japan, somewhat of a laggard despite longstanding automation of its factories, has set up the Industrial Value Chain Initiative. The United Kingdom is similarly focusing on advanced supply chains. France and Italy have smart factory programmes and the Netherlands a smart industries equivalent. In 2015, the European Commission launched the Cloud-based Rapid Elastic Manufacturing research project to promote the concept.

China, already the world's largest market for industrial robots, is closely following the German model and spending heavily on industrial R&D to support a national goal for its advanced manufacturing to be on an equal footing with the United States, Germany and Japan by 2045.

Benefits

All these nations see Industry 4.0 as enhancing the global competitiveness of their industrial firms and providing a potential resurgence of manufacturing production and exports that will create and retain domestic manufacturing jobs as well as potentially repatriating those previously lost to lower-cost developing economies.

Industry 4.0 could help developed economies create and retain domestic manufacturing jobs

Potential efficiency gains through the agility, flexibility and scalability of cyber-physical production systems should lower manufacturers' costs, raise product quality and productivity, as well as promise disruptive product innovation.

However, while some production in developing economies may return to developed countries, increasingly the need to produce goods locally, especially in new growth markets, will inform decisions on where to locate production.

Obstacles

Multiple hurdles remain to widespread implementation.

Reliability and safety

Engineering across the digital-physical divide is not a trivial problem. Nor is the integration of heterogeneous and legacy systems across internal and external networks. The much greater complexity of cyber-physical systems over conventional manufacturing means many more potential points of failure, which will be of particular concern to the medical and healthcare industry.

Standardisation

Machines will need standard interfaces -- with global acceptance -- to communicate with each other and share data seamlessly. These standards will likely take years to be agreed and be a point of national government contestation.

Security

Industry 4.0 requires high levels of data sharing. This will further elevate the already heightened cyber risks of data theft, industrial espionage and other cyberattacks (see INTERNATIONAL: Demand will outpace cyber insurance - August 12, 2016).

Corporate resources

Surveys show that most companies lack both the staff and IT infrastructure to make the transformation to Industry 4.0. This is particularly true for small and medium-sized companies, although they potentially could be the greatest beneficiaries from Industry 4.0.

Uneven technology development

Industry 4.0 requires the exponential growth of many new technologies from artificial intelligence to nanotechnology. These are unlikely to happen in parallel.

Legal issues

Questions of legal liability, data privacy and protection of intellectual property (IP) will become increasingly complex and new legal frameworks will be needed.

Data sharing and IP rights will be a particular problem for companies operating in countries where state controls over data are extensive and used as a policy tool of industrial protectionism.

Taxation

3D printing will allow the production of products across countries with no physical crossing of national borders, putting new demands on VAT and custom duties regimes.

Labour markets

A report for the International Federation of Robotics in 2013 forecast that industrial robots would create 1-2 million new jobs in 2017-20. However, a frequently cited study by Oxford University researchers Carl Benedikt Frey and Michael Osborne the same year forecast that many times that number of jobs would be at risk in industrialised economies.

It seems likely that, as happened in earlier industrial revolutions, the effects on labour markets will be asynchronous (see INTERNATIONAL: Artificial intelligence - June 28, 2016). Displaced unskilled or semi-skilled production workers will not have the skills or qualifications needed to be employed in Industry 4.0, possibly on a large scale, while at the same time there will be skills shortages.

This will profoundly challenge policymakers in the provision of education and training to deal with skills mismatches and social welfare provision for displaced workers.