A Gulf human rights pushback worsens EU dilemmas

Before the latest Saudi-Canada spat, similar tensions had already hit Gulf-EU trade and business ties

A spokeswoman on August 7 said that the EU was “seeking clarification” over Saudi arrests of human rights activists that have caused a major diplomatic row with Canada. Riyadh reacted to Ottawa’s criticism of the arrests by breaking diplomatic ties and immediately withdrawing investments, trade, students and medical patients, demanding support from allies. On a smaller scale, Saudi Arabia and the United Arab Emirates (UAE) have also recently acted to punish and reward various European countries over human rights criticism and their position on issues such as Iran sanctions, the Yemen war and approaches to the Qatar blockade.

What next

As the US clash with Iran heats up, tensions between Gulf Cooperation Council (GCC) countries and Europe could mount further, with upcoming flashpoints including over Yemen. Further EU responses to the Canada case could also anger Riyadh. The long-term trajectory in bilateral EU-GCC relations is likely to be negative, based on a perceived widening divergence of interests, as well as Gulf countries’ rising consciousness of their own financial power and of shifts in global public opinion away from human rights norms.

Subsidiary Impacts

- Especially critical EU countries such as the Netherlands and Germany will see the worst deterioration in GCC trade and business ties.

- The UK and France may receive future tangible rewards for their positive engagement, including new investments.

- GCC countries will seek to diversify their political and economic relations further, including in Asia.

- European-Gulf relations will be more driven by political developments and prone to periodic crises.

Analysis

European countries have increasingly clashed with Saudi Arabia and the UAE over issues including arms exports and human rights in Yemen and the future of relations with Iran.

Yemen war

In 2015-18, under public pressure, the Netherlands, Norway, Belgium, Germany and Sweden all progressively suspended or limited arms sales to Saudi Arabia and the UAE over alleged humanitarian violations in Yemen.

The European Parliament adopted a resolution in 2016 calling for an arms embargo on Saudi Arabia, and legal challenges against Saudi arms deals with Arabia are pending in several countries.

Many EU states are concerned over apparent human rights abuses, including not only civilian casualties from coalition bombing but also allegations of disappearances of human right activists, secret torture prisons, the use of starvation tactics and the recruitment of child soldiers (see YEMEN: Northern civilians face new suffering - May 31, 2018).

An upcoming UN human rights report could deepen divisions

For three years, an alliance of European countries led by the Netherlands unsuccessfully petitioned the UN Human Rights Council for greater scrutiny of human rights abuses in Yemen. In 2017, the Council adopted a compromise solution, appointing a group of eminent experts to investigate the issue. The group is due to report in September 2018, likely leading to another bruising encounter between European countries and the Saudi-led coalition at the UN.

Iran's role

The issue of Iran is even more important to explaining current tensions, especially with Germany. Saudi Arabia, the UAE and Bahrain are emphatic in their support for the US administration's decision to withdraw from the 2015 multilateral nuclear deal and reimpose harsh sanctions.

By contrast, EU countries are searching for ways to blunt sanctions, preserve the agreement and continue business relations with Iran (see IRAN: Partners will struggle to save the nuclear deal - May 9, 2018). GCC press commentators and diplomats speaking off the record have harshly criticised Europe's lack of solidarity on this issue.

Despite the contrasting rhetoric, the relative impact of the US Iran sanctions is not straightforward. While major European companies are shelving investment plans, some Gulf countries are themselves struggling to adjust.

Sanctions will undermine Dubai's role as a trading hub and financial centre for Iran, but Tehran is seeking to promote Doha to that position. Although Gulf oil producers will benefit as some Asian countries halt their imports of Iranian crude, trade tensions mean Beijing may also turn to Tehran to replace US crude oil imports.

China, Russia and Turkey will be the prime beneficiaries from the reduced European presence in Iran, taking over business and contracts. Saudi Arabia and the UAE have sought to win over China and Russia by offering trade opportunities rather than limiting business, as with Europe -- reflecting a very different understanding of their foreign policy parameters.

Impact on business

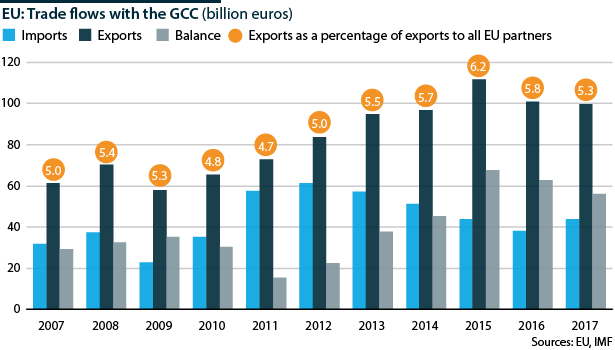

Collectively, the EU remains the GCC's largest trade partner, with bilateral trade reaching 143 billion euros (166 billion dollars) in 2017.

However, political disagreements are starting to affect some business ties:

- Following a quarrel over Lebanon, Riyadh withdrew its ambassador from Berlin in November 2017; he has still not returned.

- In late May, news media reported that Saudi government agencies had been instructed not to renew non-essential contracts with German companies.

- There were simultaneous unconfirmed reports that the UAE was suspending medical treatment for its citizens in Germany, formerly a major hub.

- Saudi and Emirati business partners and government contractors have also warned German and Dutch companies of further economic consequences unless there is a change in their governments' policies on key international issues.

More broadly, Gulf countries have signalled that they are not interested in renewing negotiations on an EU-GCC free trade agreement (FTA) and remain lukewarm about bilateral Partnership and Cooperation agreements. The potential inclusion of human rights issues and cumbersome economic regulations -- and the suspicions that FTAs will work against diversification in the Gulf -- are driving that reluctance.

There is little Gulf enthusiasm for wider EU economic agreements

Some GCC states increasingly view Europe as an obstacle more than an ally -- causing them, for example, to support Brexit and build ties with right-wing nationalist leaders.

Exceptions

In contrast to this general trend, the UK and France benefit from a more cautious approach. Both have substantially increased arms exports to the Saudi-led coalition in Yemen and provided logistical support to the war effort. London has been helpful as penholder on Yemen at the UN Security Council; Paris in June 2018 cooperated with Riyadh over a humanitarian conference for Yemen.

These two countries signed high-value business deals with Saudi Crown Prince Mohammed bin Salman when he visited the two countries in March and April. GCC leaders have also promised a post-Brexit trade deal with the UK.

On the other side, among GCC countries, Qatar, Oman and Kuwait have been much more open with the EU (see SAUDI ARABIA/UAE: Deeper cooperation may be divisive - July 10, 2018):

- Doha sees closer European ties as vital insurance, causing it to compromise on aviation and other issues.

- Muscat -- with less to offer in commercial terms -- fears it could be the next Saudi-Emirati target and wants more allies.

- Kuwait has built its foreign policy on keeping on good terms with everyone.

Long-term trajectory

Beyond the current differences, as GCC countries seek to diversify their business dealings for both economic and political reasons, the long-term outlook for EU-GCC business ties looks negative.

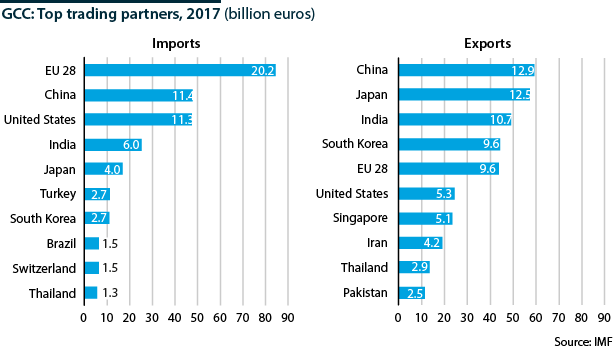

China has become the single largest trade partner of both the UAE (54 billion dollars in 2017) and Saudi Arabia (42 billion), with India close behind in the Emirati case. During a recent state visit by Chinese President Xi Jinping to Abu Dhabi, the two countries pledged to double bilateral trade.

Saudi Arabia and the UAE have also both increased business ties with Russia, which have included substantial investments in the Russian economy through the Russia Direct Investment Fund.

By contrast, there is little momentum to deepening EU-GCC business relations, apart from in select bilateral cases.