Multilateralism risks will rise amid World Bank change

Selecting a successor could cause governance shockwaves following the sudden resignation of the World Bank president

The World Bank Board of Executive Directors meets in Washington today to discuss the process for selecting a successor to President Jim Yong Kim, who resigned on January 7. Kim's departure creates unforeseen turbulence at the institution, whose corporate commitments around climate change, gender and renewable energy are anathema to the current US administration.

What next

The US administration could nominate a centre-right candidate who supports the Bank’s current approach, or an ideological conservative who supports rolling back the Bank’s emerging markets commitments. Bank shareholders would be likely to vote against such a combative candidate, supporting a non-US candidate instead. Most likely is that interim President Kristalina Georgiana is appointed for the rest of Kim’s term as many other issues occupy the US administration and Europe is likely to vote with the United States to protect its hold over the IMF managing-director position. The process will be no less conflicted in 2022.

Subsidiary Impacts

- If the US nominee is an ideological conservative, World Bank relations with either the United States or other shareholders will be damaged.

- Short-term impacts on Bank operations will be minimal.

- Kim’s belief that he can affect “global issues” more in the private sector emphasises the importance of the Bank reviving its global role.

Analysis

Kim's email to staff announcing his departure with three years of his second term remaining elicited surprise. Having pushed gender and climate change to the centre of the Bank's agenda, Kim risks undermining his legacy by offering US President Donald Trump an opening to appoint his successor.

'Gentlemen's agreement'

The heads of the World Bank and IMF have been nominated by the United States and Europe respectively since the institutions were created in 1946. The arrangement reflected post-war power politics and these blocs' financial contributions to the institutions.

This 'gentlemen's agreement' has come under fire since the 1980s as emerging markets account for an increasing share of global GDP and population. At the World Bank, the unpopular presidency of Paul Wolfowitz (2005-07) sparked campaigns for reform of the selection process (see INT: Governance reform will be hard in the Trump era - June 22, 2017). The institution's governors committed to selecting its leader through an "open, transparent and merit-based process" in 2011.

Kim appointment and performance

Born in Seoul in 1959, Kim trained as a doctor and medical anthropologist and then led a healthcare charity and Dartmouth College. His World Bank appointment partly arose from then US President Barack Obama's political incentives in 2012. Kim's nomination assuaged potential critics from the right -- who prioritised US control -- and the left, who favoured a change from US-born white male leaders.

Kim travelled to 22 countries in 17 days to promote his candidacy and won despite vigorous efforts to promote non-US candidates: Ngozi Okonjo-Iweala of Nigeria and Jose Antonio Ocampo of Colombia. Arguably European votes secured his appointment, seeing more benefit from continuing the 'gentlemen's agreement' than from supporting Ngozi -- widely seen as more qualified.

European support for its 'gentlemen's agreement' with the United States stymied the case of a well-qualified non-US candidate in 2012

An ambitious change process has hampered Kim's effectiveness, but his stable regime has bolstered the Bank as a lynchpin of multilateral cooperation. He cultivated relationships with Silicon Valley and investors.

Global practices

Kim hired McKinsey to reorganise the Bank's lending and technical assistance teams, but this failed to reap the promised efficiency gains, weakening Kim by squandering his capital with staff and the Board.

Twin goals

He emphasised his role as a communicator, redefining the institution's mission around two priorities -- reducing extreme poverty to 3% by 2030 and maximising income growth for the bottom 40% in countries where the Bank is active.

Capital increase

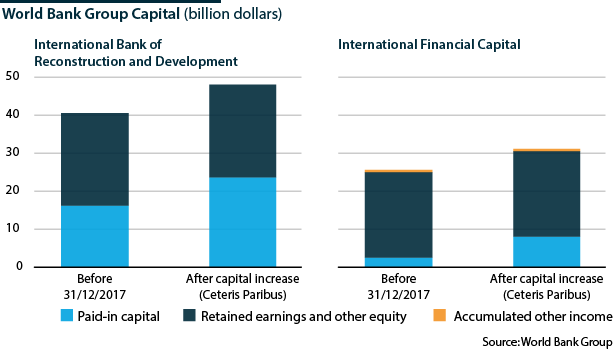

His 6.5-year tenure coincided with replenishing the International Development Association (the Bank's fund for low-income countries) and increasing the capital of the International Bank for Reconstruction and Development (its lending arm for middle-income countries) (see INTERNATIONAL: More money will bolster the World Bank - May 16, 2018). The commitments exceeded expectations and strengthened the institution.

Succession

After his 2016 appointment to a second term, Kim devolved authority to Kristalina Georgieva -- the highly regarded former EU budget chief -- whom he brought in as chief executive (see INTERNATIONAL: World Bank chief faces diplomatic test - May 15, 2017).

The board has appointed Georgieva as interim president following Kim's departure to private equity firm Global Infrastructure Partners.

At today's meeting, the Dean of the Board of Executive Directors, Merza Hasan of Kuwait, will instigate the selection process. Hasan yesterday recommitted to the principles of "open, transparent and merit-based" selection.

US stance

The form and substance of the Trump administration's engagement on World Bank succession is a key uncertainty. Treasury officials have been willing to take a hands-off approach, going along with the 13-billion-dollar capital increase despite Trump's stated desire to shrink development institutions. However, should Trump himself engage on the issue, a more combative stance could ensue.

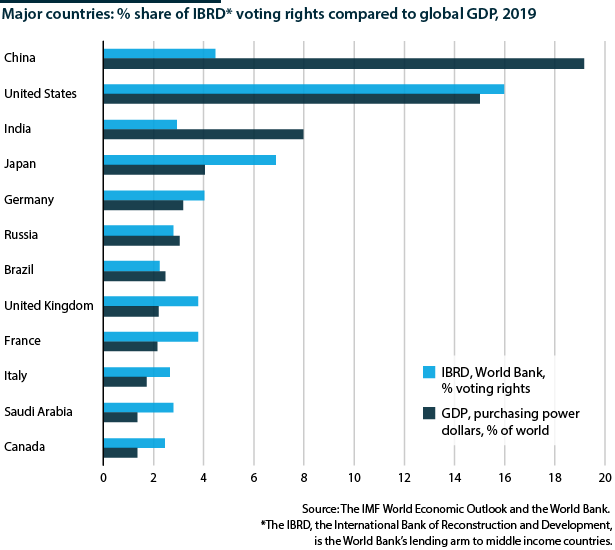

The United States would find it hard to stomach the loss of control of the World Bank presidency. Under-Secretary of the Treasury for International Affairs David Malpass has voiced concerns about "worrisome" Chinese inroads at multilateral lenders (see INTERNATIONAL: Infrastructure financing will rise - February 3, 2017).

Treasury Secretary Stephen Mnuchin is likely to seek a candidate acceptable to Trump and the World Bank's other shareholders -- but this may be hard to achieve.

The US administration may struggle to nominate a candidate acceptable to Trump and the Bank's other shareholders

Nominee scenarios

Several scenarios could follow.

Centre-right candidate

Malpass, a former Bear Stearns chief economist, might secure the US nomination, or the Treasury might identify a senior and respected US business leader. Such a candidate could secure other shareholder support provided he or she pledged continuity with the current approach, especially on climate change.

The nominee is likely to face an unprecedently strong field of rival candidates, drawn from emerging market leaders in the vein of Okonjo-Iweala -- but concern for the IMF leadership would likely swing European votes towards another US chief at the Bank.

Ideological conservative

If Trump or his inner circle engage on the issue, the nominee could be an ideological conservative committed to rolling back the Bank's stance on climate change or reducing its engagement in emerging markets including China and India.

With the United States holding only 15% of World Bank shares, such a nominee would stand a high chance of being defeated -- ending the US monopoly on the position.

Shock waves

The voting down of a Trump nominee could have significant repercussions:

- The United States could plausibly pull capital.

- Europe might lose its ability to count on US votes for its next IMF managing-director candidate.

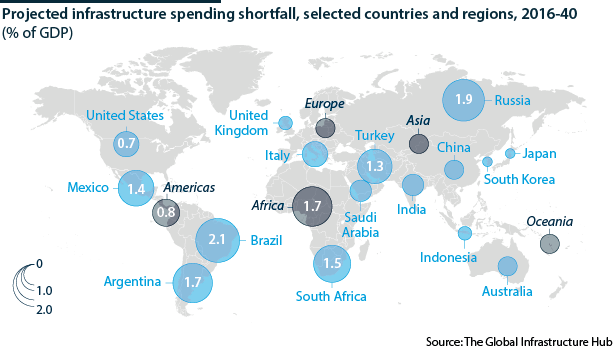

The World Bank might, nonetheless, benefit from greater legitimacy as a result of being led by an African, Asian or Latin American. By aligning its leadership with the countries it serves and that provide increasing amounts of its capital, the Bank could become a stronger vehicle of global governance, stemming the shift of influence to bodies such as the Shanghai-based Asian Infrastructure Investment Bank.

In this scenario, public-private project financing in emerging markets could gain more momentum.

Compromise

With Trump focused on US-Mexico border issues -- and France, Germany and the United Kingdom preoccupied domestically -- the most likely scenario is that the Board will wait out the US reaction and then assuming no strong White House engagement, appoint Georgieva to serve the remainder of Kim's term.

Whether Trump or another is president in 2022, the succession process will again be conflictual.